Asian stocks lower after Wall Street tumbles

Updated: 2011-08-11 15:00

(Agencies)

|

|||||||||||

|

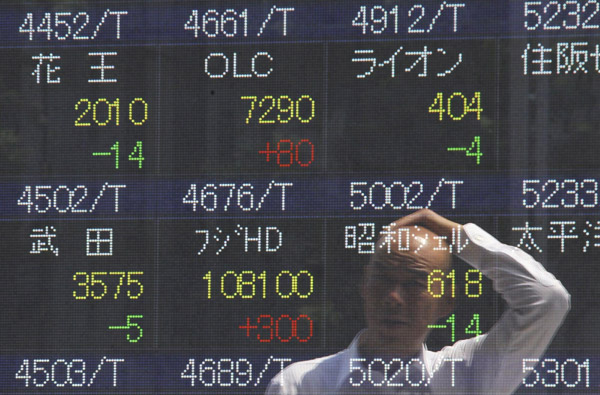

A man scratching his head is reflected on an electronic board displaying share prices outside a brokerage in Tokyo August 11, 2011. [Photo/Agencies]

|

BANGKOK - Asian stock markets followed Wall Street lower Thursday as concerns mounted over the worsening debt crisis in Europe and a slackening global economy.

Oil prices hovered below $83 a barrel, while the dollar slipped against the yen and the euro. Markets continued to wobble amid pessimism about the health of the world's major economies. But the falls in Asia were muted compared with Wall Street.

Japan's Nikkei 225 index slipped 0.7 percent to 8,968.82 as a strengthening yen, which reduces the value of export earnings, clobbered Japan's crucial export sector.

Honda Motor Corp. lost 2.9 percent, while Nissan Motor Corp. stumbled 3.8 percent. Toyota and Mazda Motor Corps. each fell more than 2 percent. Consumer electronics giants also slid - Sony Corp. by 2.4 percent and Panasonic Corp. by 2 percent.

Hong Kong's Hang Seng index stumbled 1.5 percent to 19,496.70. South Korea's Kospi, vacillating in and out of negative territory, was up 0.9 percent at 1,822.74. Australia's S&P/ASX 200 was flat at 4,141.60 after earlier dropping about 2 percent.

A few markets eked out gains. China's Shanghai Composite Index added 0.4 percent to 2,560.12. Benchmarks in New Zealand and the Philippines also gained.

Lee Kok Joo, head of research at Phillip Securities in Singapore, said investors were still reeling from the effects of the US credit downgrade, poor economic outlook and fears of possible credit downgrades of AAA rated countries in Europe.

"Investors are keeping a portion of their holdings in cash and are waiting for a more opportune time to get into the market," he said.

US weekly jobless claims, due to be released Thursday in Washington, would be a key factor in determining market direction in the coming days, he said.

"That is a very important number for the week," he said. "If that is disappointing, then that would cement investor fears that the employment situation in the US is getting worse."

In Sydney, Australia's largest telecommunications company Telstra Corp. jumped 6 percent after forecasting slight improvements in both earnings and revenue in the year ahead. The Melbourne-based company said it had strong 16 percent growth in mobile phone customers.

Australian gold miner Newcrest Mining gained 4.3 percent, benefiting from the surge in gold prices. Hong Kong-listed Zijin Mining Group, China's biggest gold miner, rose 3.8 percent.

On Wall Street on Wednesday, the Dow Jones industrial average closed down 519 points, still reeling from a slap last week by Standard & Poor's rating agency, which stripped the US of its AAA credit rating. That sent global stocks into a tailspin.

The Dow closed Wednesday at 10,719.94, down 4.6 percent. The S&P 500 finished the day down 4.4 percent and the Nasdaq composite index down 4.1 percent.

On Tuesday, the Federal Reserve said it planned to keep interest rates ultra-low for two more years since it sees almost no chance that the US economy will improve substantially by 2013.

The other major market concern is Europe's debt crisis. Investors have grown increasingly worried that Italy and Spain could become the next European countries to have trouble repaying their debts. Greece, Ireland and Portugal have already received bailout loans because of Europe's 21-month-old debt crisis.

The fears have pushed investors to shun Spanish and Italian bonds, which have led to higher borrowing costs for the two countries. The European Central Bank stepped in Monday and began buying billions of euros worth of their bonds.

Benchmark oil for September delivery was down 27 cents to $82.62 a barrel in electronic trading on the New York Mercantile Exchange. Crude rose $3.59, or 4.5 percent, to settle at $82.89 on Wednesday.

In London, Brent crude was down 48 cents to $106.20 per barrel on the ICE Futures exchange.

In currencies, the dollar weakened to 76.62 yen from 76.83 yen late Wednesday in New York. The euro rose to $1.4214 from $1.4208.

Related Stories

Hong Kong stocks fall 2.35% 2011-08-11 10:56

Banks and commodity producers help stocks to advance 2011-08-11 10:25

Chinese stocks fall to 12-month low Tuesday 2011-08-09 17:12

- China slows bullet trains to ensure safety

- Asian stocks follow Wall St dip

- Trade surplus rises on export surge

- Japan's PM signals he's ready to quit

- ROK, DPRK exchange artillery fire

- Cameron has lost legitimacy: Libya

- China puts brakes on bullet trains

- China's refitted aircraft carrier starts sea trial

Hot Topics

The European Central Bank (ECB) held a conference call late on Sunday ahead of the market opening, pledging the ECB will step in to buy eurozone bonds with efforts to forestall the euro zone's debt crisis from spreading.

Editor's Picks

|

|

|

|

|

|