|

|

|

|

|||||||||||

Higher global crude costs, falling domestic inflation lead to decision

|

|

Vehicles queue to fill their tanks before the fuel price hike at midnight at a petrol station in Fuzhou, Fujian province March 19, 2012. [Photo/Xinhua] |

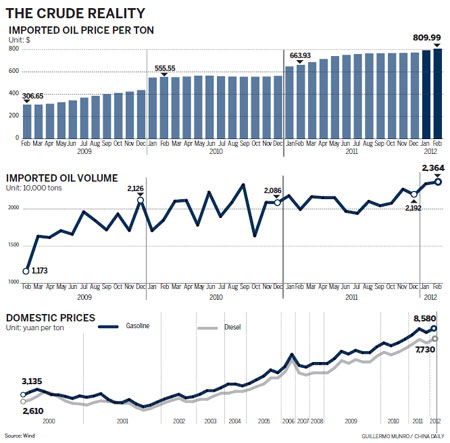

China raised fuel prices for the second time this year, hiking gasoline and diesel by 6.5 percent to 7 percent effective on Tuesday, amid rising world crude oil prices and falling domestic inflation.

Prices went up by 600 yuan ($94.90) a metric ton, the biggest hike since June 2009.

The average gasoline price went up 6.5 percent to 9,980 yuan a metric ton, while diesel prices rose 7 percent to 9,130 yuan a metric ton.

Both prices are record highs.

China, the world's second-biggest oil user, raised fuel prices for the first time this year by 300 yuan a ton on Feb 8.

The prices are set in reference to a basket of crudes (Brent, Dubai and Cinta), which jumped more than 10 percent in the past 22 working days.

That surge laid the foundation for the hike, the National Development and Reform Commission (NDRC) said on Monday.

The NDRC said the raises will take effect before the spring peak use period to discourage speculation and hoarding and thus guarantee supply.

China introduced the current system in 2009, under which it adjusts refined oil product prices when the basket moves more than 4 percent within 22 working days.

The formula allowed for a price hike of 700 yuan a metric ton this time around, but the government limited the increase in consideration of affordability, said the NDRC, China's top economic planner.

"The increase is much higher than the market consensus of about 300 yuan. We reckon it is due to easing domestic inflation and weaker demand on the backdrop of an economic slowdown from previous years," said Wang Jintao, an analyst at chem365.net, an online information provider for the petrochemical industry.

The consumer price index, a main inflation indicator, rose 3.2 percent year-on-year in February, a 20-month low.

China's foreign oil dependency jumped to 56 percent in 2011 from 30 percent in 2000. That's not a sustainable trend in light of the country's long-term demand for oil, so China is using the pricing system to curb excessively rapid increases in oil use, the NDRC said.

Central government subsidies to the agriculture, fishery, forestry, urban public transportation and taxi industries will be provided to offset the price hikes, the authority said.

The frequency of price adjustments - two times in as many months this year - is much more than in previous years. The government raised prices only three times last year.

The change of frequency may be a means for the NDRC to test the public response to increased price volatility, laying a foundation for further reforms, said Cindy Liang, a senior analyst at the energy information provider Platts.

The latest hike could also lift domestic refineries out of the red. These facilities were losing about 600 yuan a ton under the previous fuel prices, Liang said.

China National Petroleum Corp, the country's biggest energy company, lost 50 billion yuan in its refining division last year, Chairman Jiang Jiemin said, adding that the losses would increase this year.

"What is critical now is for the government to provide more clarity into the current scheme, which can give us leeway to adjust production and reduce losses," said Rong Guangdao, chairman of Sinopec Shanghai Petrochemical Co, which has an annual refining capacity of 12 million tons.

There's widespread market speculation that China will reduce the price-adjustment reference period to 10 days, from 22 days, to better reflect volatile global oil prices.

The NDRC hasn't said when it might further reform the pricing system.

You may contact the writer at zhouyan@chinadaily.com.cn

Wu Ying, iPad, Jeremy Lin, Valentine's Day, Real Name, Whitney Houston, Syria,Iranian issue, Sanyan tourism, Giving birth in Hong Kong, Cadmium spill, housing policy

|

|

|

|

|

|