|

|

A visitor poses in front of an artist impersonating French emperor Napoleon inside Parisian Macao, which is part of the Las Vegas Sands development in Macao. REUTERS |

Old and new casinos pour in billions of dollars into local economy, promising to reverse recent slump

A cluster of splendid new casinos on the way to Macao highlights the operators' efforts to lure gamblers back. Hopes are high for a recovery in the gaming industry. Some think it is probably on the cards.

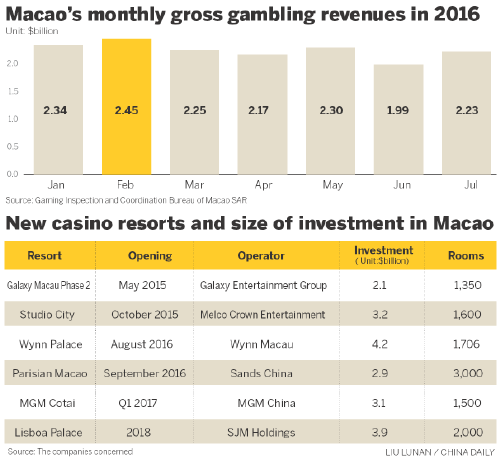

That may be because Macao's casino operators had another busy year of constructions. The world's largest gaming hub last month added its most expensive casino-the $4.2 billion Wynn Palace from the stable of US casino mogul Steve Wynn. Just a month after that, American billionaire Sheldon Adelson's $2.9 billion Parisian Macao opened.

MGM Resorts will follow next year with the $3.1 billion MGM Cotai, while SJM Holdings is on track to open the $3.9 billion Grand Lisboa Palace in 2018.

Such a hive of new casinos comes after Macao's gross gaming revenue fell 4.5 percent in July to $2.2 billion, stretching declines for the 26th month in a row.

However, July's revenue beat analysts' estimate of 5.5 percent drop, fitting the optimistic tone of casino tycoon Sheldon Adelson and JP Morgan Chase that sees signs of a turnaround on the horizon.

Gaming has been part and parcel of Macao since the 1850s, when Portuguese administrators made it legal and taxable. Local gaming industry has exploded after foreign casino operators were allowed into the market in 2002.

According to global ratings agency Moody's, gaming accounts for 58.3 percent of Macao's gross domestic product and contributed to roughly 75 percent of total government revenues.

Macao is the only place in China where gambling is legal. The territory cemented its status as the world's No 1 gaming center in 2006, when its gambling revenues outstripped that of Las Vegas for the first time. During that time, the city's casinos pulled in a record $4.57 billion in revenue in a single month.

The Las Vegas of Asia started to lose some shine since 2014, however, when Beijing's crackdown on corruption and extravagance amid floundering mainland economy scared mainland high-rollers away to other regional gaming destinations.

Cambodia comes as an emerging rival, whose Hong Kong-listed casino operator NagaCorp posted a 24-percent surge in net profit to $125.2 million for the first half of 2016, with a shiny new casino of 200 gaming tables on the way in 2017.

This compares Wynn Macao's 20.6 percent tumble in net profit to $1.14 billion, and Sands China's 25 percent decrease in net profit to $551 million over the same period.

Stanley Au Chong-kit, chairman of Macao-based bank Delta Asia Financial Group believes policymakers' tough stance on curbing gambling growth is a sure thing for the foreseeable future.

"By 2018, at the latest, some casinos failing to make ends meet would be forced to restructure," he said. "But the point is, why does the market cling to the hope of a turnaround, defying the fact that the gambling business has already developed excessively in Macao?"

Even when a whopping 34.3 percent drop in profit sent jitters across local casino operators last year, the territory's $29 billion gross gaming revenue is still three times that of Las Vegas, six times of Singapore, and ten times of South Korea and the Philippines, said Macao Chief Executive Fernando Chui Sai-on.

For the first half of 2016, Macao's $13.5 billion gross gaming revenue was down 13 percent from a year earlier, but is still more than any others across the globe.