|

|

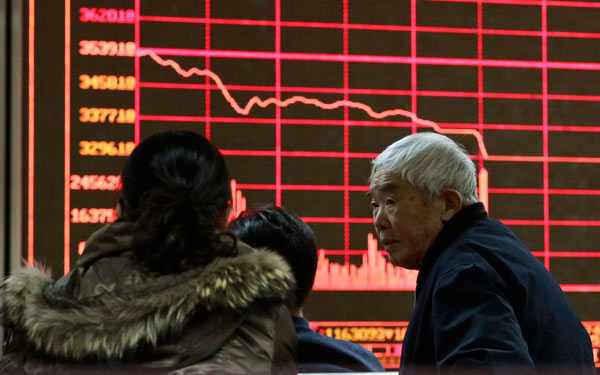

Residents monitor stock information in Beijing on Monday, when trading on China's stock markets closed around 1:30 pm after shares plunged, triggering the new circuit breaker. [Photo/China Daily] |

Sell-off triggers use of new circuit breaker; investors urged to be rational and cautious

Chinese equities plunged on Monday, marking the worst-ever start of a year, as the intensity of the sell-off startled investors who sought to dump shares to avoid further volatility.

The benchmark Shanghai Composite Index slumped by 6.86 percent, or 242.92 points, to close at 3,296.26. The smaller Shenzhen Component Index suffered an even heavier loss, down by 8.2 percent, or 1,038.85 points, to close at 11,626.04.

Nearly 1,400 stocks in both Shanghai and Shenzhen tumbled by the 10 percent trading limit.

The sell-off was widely regarded as a rare and historic event in the Chinese stock market, since it triggered the circuit breaker mechanism that became effective on Monday. It was the first ever introduction of an emergency brake mechanism by the Chinese regulator to calm the market when it experiences abnormal price swings.

Trading of stocks, index futures and options was halted for the rest of the day after the CSI 300 Index, which tracks some of the largest-cap stocks in Shanghai and Shenzhen, plunged by 7 percent at around 1:30 pm on Monday.

Both the Shanghai and Shenzhen stock exchanges issued statements immediately after the trading halt, urging investors to be rational and watch out for trading risks.

"Monday's sell-off was a rare incident. For the past 11 years, the opening day of the year has never been so negative," said Hong Hao, chief strategist at investment bank BOCOM International Holdings Co.

China's securities regulator announced the plan to introduce the circuit breaker mechanism in December. The mechanism was part of the regulator's effort to prevent the market from repeating the volatile trading during the summer that wiped out nearly $5 trillion in market value.

According to the rule, trading will be suspended for 15 minutes when the CSI 300 fluctuates by 5 percent. Trading will be halted for the remainder of the day when the index moves by 7 percent at any time during the trading session.

"The trading halt obviously worked against the regulator's will. The plan was to suppress market volatility, but indeed it appeared to have magnified volatility," Hong said.

Analysts said that the A-share market has also been burdened by a slew of negative factors, including disappointing economic data, a weaker yuan and fluctuations in the global markets.

The Caixin manufacturing purchasing managers index, a gauge of China's manufacturing activity, decreased to 48.2 in December, down from a five-month high of 48.6 in November. Numbers below 50 indicate a deceleration. The government's index posted similar figures.

Meanwhile, the Chinese central bank guided the reference rate for onshore renminbi lower on Monday at 6.5023 against the US dollar, the weakest level since 2011.

"The anticipation of a weak yuan is creating big pressure for the stock market, as investors may sell the Chinese equities and increase holdings of dollar assets," said Zhang Jie, a professor of finance at the capital research center of China University of Political Science and Law.

The A-share market plunge also triggered a sell-off in the European markets on Monday. The British market opened sharply lower, with the FTSE 100 Index tumbling by 1.9 percent during morning trading.