|

|

A customer buys carrots at a supermarket in Handan, Hebei province, on Thursday. Food prices rose 3 percent and were the main driver of inflation in August, according to the National Bureau of Statistics. HAO QUNYING/CHINA DAILY |

The inflation rate eased to a four-month low in China during August, confirming that the economy remains under pressure and providing further room for policy fine-tuning.

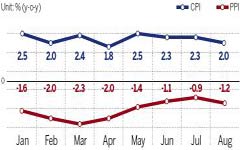

The Consumer Price Index rose just 2 percent year-on-year last month, compared with a 2.3 percent gain in July, the National Bureau of Statistics said on Thursday.

Food prices rose 3 percent and were the main driver of inflation, contributing 1.01 points of the total gain. Breaking down food by category, the price of fresh fruit surged 21.2 percent, while the price of pork, a staple of the Chinese diet, remained flat.

For the first eight months, the CPI was up 2.2 percent, far below the official full-year target of 3.5 percent.

Analysts said that inflation will be controllable in the coming months, which will allow more room for targeted policy easing.

|

|

|

In the first eight months, the PPI dropped by 1.6 percent year-on-year.

Yu Qiumei, senior statistician at the NBS, attributed the decline to the falling prices of industrial products and raw materials. Prices of crude oil and refined oil products ended a rising streak and started falling in August. Prices of coal, steel, concrete and cement continued to decline. Yu said market conditions for such products will remain "grim" as overcapacity persists, dragging prices down.

The decline in inflation was in line with the Purchasing Managers Index in August, which showed that new orders were suppressed by shrinking demand.

Zhang Shiyuan, a researcher with Southwest Securities Co Ltd, said the inflation statistics were worse than expected and show that the economy still lacks momentum.

"A proactive fiscal policy and prudent monetary policy are still necessary, and we should step up efforts in implementing investment in infrastructure projects," said Wen Bin, chief researcher with Minsheng Securities Co Ltd.

Premier Li Keqiang on Wednesday said China can meet its major economic goals this year and that policymakers will not be distracted by short-term fluctuations in individual indicators.

He ruled out the possibility of a hard economic landing and vowed there will be more "targeted policy fine-tuning", as well as reform and innovation in the administration system, to help the economy overcome any difficulties.

First-half GDP rose 7.4 percent year-on-year, showing strong resilience after a disappointing start to the year. A poll by Hexun, a business website, that covered 10 economic research institutions found the consensus for third-quarter GDP growth is 7.4 percent.

"A slowdown in growth during the process of transformation is the nature of any economy," said Tang Jianwei, a Shanghai-based macroeconomist at Bank of Communications Co Ltd.

"Short-term stimulus policies may generate short-term growth, but they are not conducive to long-term sustainability. A sustainable dynamic in Chinese economy still lies in reform. Therefore, the focus should be on promoting reforms."

In the short term, Tang said, the fiscal and monetary policy mix is likely to be maintained. Fiscal policy will remain positive. When it comes to monetary policy, targeted easing will be the major tool, but cutting bank reserve ratio is unlikely.

Xinhua and Reuters contributed to this story.