Cooling inflation, weak PPI may prompt further policy measures

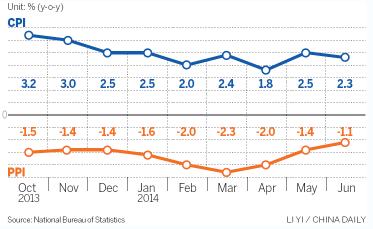

Factory-gate prices fell in June at their slowest pace in more than two years and inflationary pressure eased further, giving new indications that economic growth is stabilizing in China.

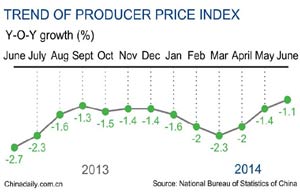

The Producer Price Index declined 1.1 percent from a year earlier, the National Bureau of Statistics said on Wednesday. The drop compared with a 1.4 percent decline in May and was the smallest since April 2012 and prompted some economists to comment that the key indicator could move out of negative territory by the end of the year.

The PPI dipped 0.2 percent on a month-on-month basis. June was the 28th straight month of year-on-year decline amid tepid demand and persistent overcapacity.

"The year-on-year decline rate has narrowed for three consecutive months and the PPI for some industrial sectors continued to rise on a month-on-month basis. This indicated positive change in the industrial domain," said Yu Qiumei, a senior analyst with the NBS.

|

|

|

Liu Ligang and Zhou Hao, China economists at Australia & New Zealand Banking Group Ltd, expect the PPI is "likely to turn positive toward the end of this year", but further monetary policy easing will still be needed to bolster confidence in China's economy.

China's inflationary pressure eased further in June as the Consumer Price Index rose 2.3 percent from a year earlier, compared with a 2.5 percent rise in May, according to the NBS.

The 2.3 percent pickup bucked previous expectations that inflation in June would be higher than in May. Some economists, however, feel that demand may weaken due to the muted inflation.

Wang Jun, a senior economist at the China Center for International Economic Exchanges, said that the data reflected demand remained weak for now. The persistent fall in the PPI signals overcapacity pressures remain, and the foundation for recovery is not that solid, he said.

In the first six months of the year, average consumer inflation was 2.3 percent, way below the official ceiling of 3.5 percent. That means the government and the central bank will have considerable room to loosen policies further to bolster the economy if needed, without risking a spike in prices, analysts said.

A recent poll by Bloomberg showed that most economists remained confident in the recovery of the Chinese economy. The proportion of respondents anticipating a recession in China over the next 12 months fell to 11 percent, the lowest level since March 2013. The historic low was set in January 2013 (at 9 percent), and it rose to 17 percent in March.

"While the chances of a hard landing are diminishing, stability may be coming at the expense of China's reform program, which is taking a back seat to guarantee the government's 7.5 percent growth target," Michael McDonough, Bloomberg's chief economist, said. "China's economy will continue facing headwinds domestically from a dragging property sector, while a weaker than expected recovery in the United States and other parts of the world may begin to weigh on external sector demand."

|

|

|

|

|