Pork imports set to hit a record

Updated: 2011-09-17 07:39

By Li Jiabao (China Daily)

|

|||||||||||

|

|

|

The United States Meat Export Federation presents US pork at a food exhibition in Nanjing, Jiangsu province. China imported 91,000 tons of US pork during the first seven months of this year, a five-fold increase from 14,900 tons in the same period last year.?[Photo /?China Daily] |

BEIJING - China's pork imports are likely to hit a record this year, but the surge will have limited influence on surging prices, analysts said.

"China imported about 400,000 tons of pork and pork offal in the first five months of this year, up 43 percent year-on-year, and imports will probably hit a record 1 million tons this year," said Ma Chuang, deputy secretary-general of the China Animal Agriculture Association.

An earlier report from the Netherlands-based Rabobank Group indicated that the potential gap between pork supply and demand would be between 2 and 2.5 million tons in 2012. The import volume of pork and pork offal will be 1.1 to 1.4 million tons this year, which will be between 25 percent and 60 percent higher than 2010's figure.

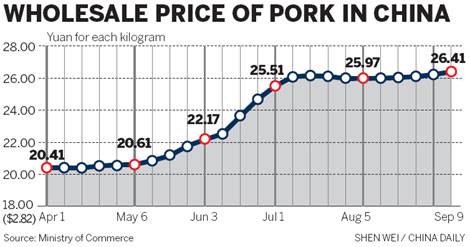

China's pork prices, a key driver of inflation, rose 0.7 percent in the week ending Sept 11 from the previous week, hitting a new record, data from the Ministry of Commerce showed on Wednesday. It was the fifth consecutive weekly rise in pork prices, according to Reuters.

"The imports of pork and pork offal will not have an actual influence on surging domestic prices because imports only account for a very small share of China's huge pork consumption, and it is not practical to turn to imports to curb the price," said Huang Guiheng, a manager in the research department of Bric Global Agricultural Consultant Ltd, a domestic market research firm.

The price of pork will continue to be high in the foreseeable future owing to the rising cost of labor, corn and feed and the risks inherent in the industry, such as stock mortality. Huang said prices will begin to decline "around the second quarter of next year, with supplies increasing from July onwards".

However, Ma said the central government will not rely on imports to regulate the price surge, although there is no limit on imports. He expects pork prices to have a "soft landing" as the market regulates itself and "steadiness and sustainability are key factors for livestock production".

China's imports of pork and pork offal reached their peak in 2008 with a volume of 910,000 tons. In 2010, the country imported 900,000 tons of pork, with Denmark being the major supplier, followed by the United States, Canada and France.

About 700,000 tons of the imports comprised offal including pigs' heads, knuckles and haslet (a form of meatloaf) which are not eaten in Western countries but are common in the diets of Asian countries.

"In the first five months of this year, more than half of China's pork imports came from the US," Ma said.

The cumulative volume of US pork imports was more than 91,000 tons during the first seven months of this year, a five-fold increase from 14,900 tons in the same period last year, according to report in the China Business News, citing the United States Department of Agriculture (USDA). China is the fifth-largest market for US pork exports.

The country has been a net importer of pork and pork offal since 2007 and net imports will maintain their momentum over the long term, a factor that will further benefit producers in Western countries.

"China's surging demand for pork and pork offal implies an optimal export scenario because pork offal is not eaten in Western countries and is not allowed to be processed into animal feed," said Ma, who suggested European and US pork producers should supply pork to their local markets and export offal to Asian countries

Moreover, farmers overseas can profit from pork offal exports and save money on disposing of the surplus, he added.

In general, it costs $40 for US farmers to dispose of a ton of chicken's feet, which are not eaten in the US but are popular in Asia, if they were not exported.

Pork offal accounts for about 12 or 13 percent of US pork production.

US pork exports are forecast to rise 4 percent to $5.2 billion in 2012 because of robust demand, particularly from Japan, South Korea, and China, according to the USDA.

Although imports of pork and pork offal accounted for less than 2 percent of China's pork consumption in 2010 - approximately 50.7 million tons - but still had a negative effect on domestic pig breeding and production.

"Imports of pork and pork offal usually come in large volumes and with higher quality but at a cheaper price, which is damaging the domestic industry," Ma said.

Another problem is the quality of pork offal, as there are no health and safety standards on these products in the US and Europe.