Concern aired over solar cell tariffs by US

Move expected to increase inflation and disrupt supply chains, experts point out

The new solar cell tariffs planned by the United States targeting companies from some Asian countries, including China, will increase inflation and consumer prices and disrupt supply chains in the US market, analysts said.

Earlier this month, the US Department of Commerce announced that 21.31 to 271.2 percent tariffs would be imposed on solar cells from Cambodia, Malaysia, Thailand and Vietnam, depending on the manufacturer.

On Dec 11, the Office of the United States Trade Representative, or USTR, announced the doubling of tariff on solar cells imported from China — from 25 to 50 percent — effective Jan 1, 2025.

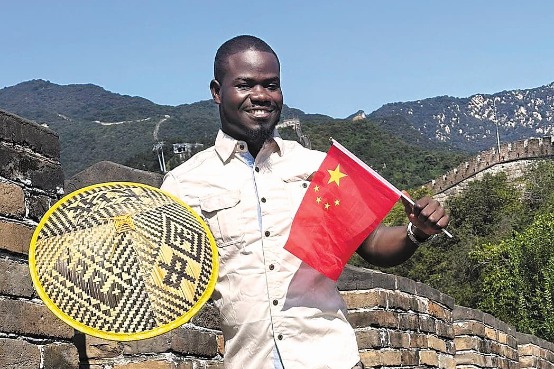

Ed Hirs, an energy fellow at the University of Houston, said the Chinese solar manufacturers would pursue other markets and expand solar installations across Asian and African countries "at a very rapid pace".

"Those nations may well turn out to be the most profitable market segment, more so than the United States at this point," Hirs told China Daily.

Hirs said the tariffs would first affect consumer spending "before we see it really having an impact on solar farm development and manufacturing of solar cells in the United States".

"The first impact, if these tariffs do go into place, is going to be a very quick and certain increase in inflation," he said.

"Applying these tariffs and targeting the Chinese companies or the nations, Thailand, Malaysia, Mexico, Canada, this is going to disrupt supply chains," said Hirs, referring to not only the new tariffs but also potential ones by the future Donald Trump administration.

When it comes to the solar panel market in the US, Hirs said that if the current manufacturers can absorb the tariffs by lowering their prices, the impact will be zero.

"If the manufacturers keep pricing at the current levels and they add a 25 percent tariff on to those, it will certainly slow down the purchasing of panels in the US," Hirs said.

The US residential solar market has already experienced a contraction in the past two years, according to an analysis by Zoe Gaston, a solar analyst at Wood Mackenzie, a UK-based energy research firm.

Attrition in market

"There has been plenty of attrition in the residential solar market, especially in the past two years," Gaston wrote. "Wood Mackenzie expects a 19 percent year-over-year reduction in residential installations in 2024."

The Inflation Reduction Act enacted by the Joe Biden administration has promoted investment in the solar industry in the US in the past two years. Another analysis by Wood Mackenzie showed the first solar panels meeting the requirements of the act's domestic content will be available soon.

The analysis found that solar panels made with US-produced solar cells were priced above 45 cents per watt while similar panels made in the US using imported cells cost buyers around 35-36 cents per watt.

With an extra 25 percent tariff, the cost between the two will be mostly eliminated. The end result will be higher prices.

"Prices have certainly increased as the tariffs have been put into place," Scott Wiater, CEO of Standard Solar, told The Marketplace.

"We're paying much more, well over double what other regions outside the United States are paying for panels with the tariffs. So, at the end of the day, it's really the end customer that's getting penalized the most," he said.

Alan Rozich, director of BioConversion Solutions and an expert in sustainability, said the solar industry is mainly an environmental sustainability issue.

"We have to look at the big picture and the performance of the devices," Rozich told China Daily. "If those are the best devices and they're practical, then they should be part of the mix."

Rozich said that tariffs on solar cells "should be waived" because "sustainability is too much of an imperative".

"I think the more the merrier. To me it's not a matter of whether it is from this country or that country. Let's all try to work together and everybody gets a cut of the pie. That's the way I would be looking at it."