If you build it they will come: China’s OBOR cements the future of investor state dispute resolution

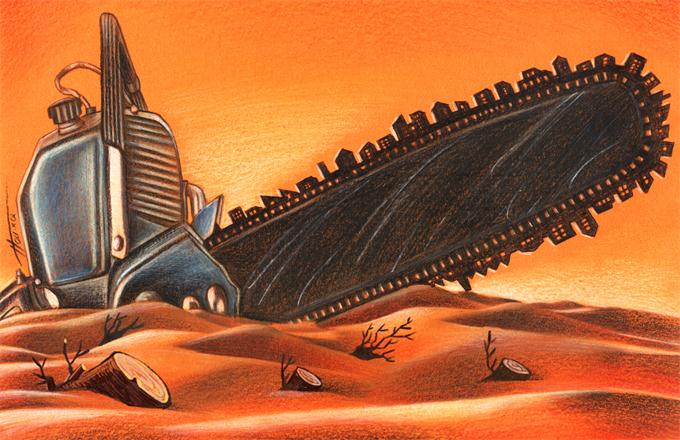

The Silk Road Economic Belt and the 21st-century Maritime Silk Road (絲綢之路經濟帶和21世紀海上絲綢之路) or One Belt, One Road (OBOR) is a dynamic development strategy and framework, proposed by Chinese President Xi Jinping in 2013 that promotes the connectivity and cooperation of countries between the People's Republic of China and Eurasia by land and a number of coastal states by sea. Indeed the reach of this network is vast, already spanning 60 nations along the land and sea routes.

Given that China alone will invest $4 trillion into the development of these trade routes and corresponding initiatives, such investment will certainly require cooperation from a number of both public and private actors in order to succeed. Undoubtedly, with the high number of parties involved, disputes will arise, and there must be an efficient mechanism for resolving those disputes.

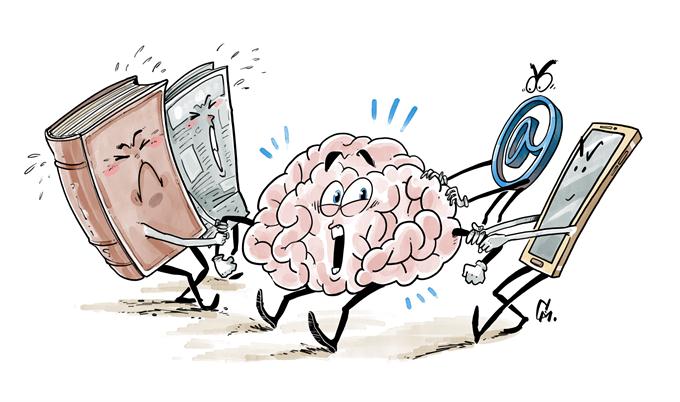

However, brokering cross-industry trade routes across many different nations that vary in terms of wealth and legal sophistication is a complex matter. When disputes arise, what legal recourse do merchants, traders, and investors have against one another? That question becomes even more intricate when a dispute originates from the government of a state where an individual is operating. The remedy to this conflict for decades has firmly been a mechanism known as Investor-State Dispute Resolution (ISDS). ISDS is a system through which individuals or organizations can sue countries for alleged discriminatory and injurious practices.

Although ISDS is often associated with international arbitration under the rules of the World Bank’s International Centre for Settlement of Investment Disputes or the United Nations Commission on International Trade Law, dispute settlement often takes place under the auspices of international arbitral tribunals governed by different rules or institutions such as China International Economic and Trade Arbitration Commission, the Hong Kong International Arbitration Centre, or the Shanghai International Economic and Trade Arbitration Commission. Regional arbitration centers like these tend to see an influx of new disputes filed to be resolved before their tribunals as commercial activity increases. Thus, it is likely that as OBOR trade routes become more established, so too will Chinese arbitralinstitutions.

ISDS and OBOR

The entire scope of both the land-based and sea-borne OBOR routes are laden with ISDS mechanisms. There are multiple bilateral and multilateral treaties between China and nations along each route that will afford for increased investor protections. Such common protections for investors found among these treaties are:

1) Compensation for expropriation or nationalizations of private assets by the state;

2) Fair and equitable treatment, as well as protection and security of investments;

3) Treatment of foreign investments in a manner no less favorable than that provided to domestic investments; and

4) Most favored nation status, which allows an OBOR investor to rely on guaranteed protections set out not only in treaties to which China and OBOR countries are parties, but potentially also any other, better substantive protections that any third-party country enjoys under its treat with the OBOR investment host state in which the investor is investing.

In summation, these protections, and the more specific ones laid out in the individual treaties, signal that China is seriously addressing investor rights in its creation of the OBOR routes. More importantly, it also signals China’s belief not only in the ISDS regime broadly as an efficient means of resolving disputes, but also bolsters China’s commitment to rule of law at a time when many economic rivals in the West are faltering in how to resolve such disputes. Such commitment to the principles of rule of law while pushing innovation economic stimulus initiatives are the sort of indicators that China should continue to highlight as it awaits its ascension to the World Trade Organization.

Despite the safeguards taken by China to ensure a fair implementation of ISDS principles, the utility of ISDS had been called into question in recent years with nations from around the world scrutinizing its value.

ISDS Criticisms: China leads the West

As China seeks to give new ground to ISDS, it seems other countries, particularly in the West, are not as confident about the alternatives of ISDS. In fact, Bolivia, Venezuela, Ecuador, South Africa, Indonesia, Italy and Russia have all withdrawn in some form or another from various investmenttreaties that avail them to the purview of ISDS mechanisms. A handful of Central American countries and Australia have also voiced their skepticism of the benefits of ISDS.

Countries that have withdrawn from the mechanism argue that it lends itself to pro-investor resolutions from tribunals, tends to lack transparency, and may have a potential chilling effect on state regulatory powers. This is not to mention the potential for biasabuse on behalf of the arbitrators, or parties seeking to by-pass national judicial systems.

Furthermore, tribunals in ISDS arbitrations have in some cases awarded billions of dollars to be paid to private investors in order to resolve disputes. Many nations are hesitant to participate in the ISDS framework because a third-party’s ability to order the state itself to pay large sums of money—which is understandably disconcerting for less familiar and stable nations.

Indeed, it seemed for the better part of the last 10 years that many states were fleeing ISDS and that the practice may fall into obscurity in favor of other dispute resolution tools, especially in light ofthe United States withdrawing from the Transpacific Partnership (TPP) which would have anchored ISDS among the international community. It appeared that even the U.S. which has never lost an ISDS case, was squeamish about the possibility of having foreign powers, even if impartial, decide if it had committed any wrong doing. However, another superpower, like China, using ISDS signals that perhaps the practice is not dead, and instead may find new life with the economically progressive Xi Jinping.

This support for ISDS may be surprising to some, allowing private parties to directly sue national governments may seem to clash with traditional Chinese values. In fact, this model of incentivized investor aggression fits the narrative of a China as the “Leader of the Free Trade World”.

ISDS, with the support of a global economic and political super power like China, will find fertile ground among the OBOR trade routes, and the paradigm established will likely facilitate the growth and proliferation of ISDS in other parts of the world. Perhaps the U.S. or Europe will create competing versions based on the success of ISDS within OBOR nations. Protected, and nurtured by a confident Chinese economic and infrastructure the future success of ISDS will certainly hinge upon its utility among the OBOR regions. For now, though it’s destiny was once uncertain, it seems that ISDS has found its way home.