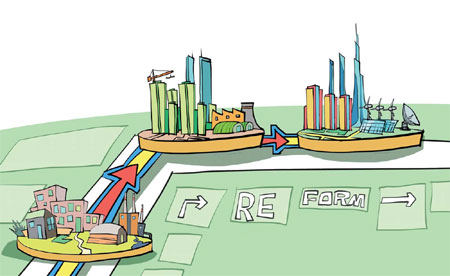

Premier juggles growth with reform

Foreign companies can no longer make big gains with market dominance

The Summer Davos meeting held in Tianjin this month offered a prime opportunity to get a take on top policymakers' latest thinking. Premier Li Keqiang expressed his opinions on the Chinese economy several times, including at a meeting with senior executives of foreign companies and in his address at the opening of the meeting.

This year the central government has worked hard to strike a balance between economic growth and restructuring. The policy stance has swung between the two.

Monetary and fiscal policies were very tight in the first quarter, and Li stressed that reform was the top priority. But since economic growth slowed to 7.4 percent by the end of March, below the yearly target of 7.5 percent, a slew of mini-stimulus policies were introduced. The monetary stance was loosened, with a greater injection of credit, and fiscal policy became slightly proactive with the approval of major railway, affordable housing and infrastructure projects. In June, Li even criticized local governors for not working efficiently to maintain economic growth. He stressed that development was the top task.

Just before the Tianjin meeting it was widely expected that there would be more stimulus and monetary loosening, with recent monthly data pointing to a weak economy.

But what Li said in Tianjin showed that he once again leaned toward structural reform and again put growth on the back burner.

He urged people to look at the bigger picture. "Partial" and "shortsighted" views were not preferred when assessing the economic situation, he said, apparently denying speculation that the world's second-largest economy was heading toward a steeper slowdown or even a hard landing amid sluggish data last month.

His confidence mostly came from rosy labor indicators.

In his meeting with foreign executives, he said that what worried the outside world most about China was its economic growth, but what preoccupied the Chinese government most was employment. New urban jobs totaled nearly 10 million by the end of last month, he said, almost achieving the yearly target. This was a handsome achievement despite the slow economy.

Li has said previously that the aim of maintaining growth was to ensure labor market stability. He has said economic restructuring can help create many jobs even if economic growth slows.

Given that thinking, Li did not seem as keen on maintaining economic growth as he did in June.

If Li's thinking does not change, further stimulus policies and greater monetary loosening are unlikely, but reform will speed up. In addition, it is likely that growth for next year may be reduced to 7 percent to give the central government more leeway in policy manipulation.

Now that it is clear Li wants to keep reform going, which fields are his major focus?

With employment the core of his concern, he may focus on the following: micro enterprises, market fairness and monetary supply.

Small and micro companies accounted for more than 95 percent of China's urban employment. Li also believes it is these companies that help create most jobs, contributing greatly in maintaining labor market stability. So he is keen to make the most of these companies by loosening administrative management. He believes that increasing government approvals and reducing restrictions are the key to the prosperity of these businesses.

For example, since March China has lifted restrictions on minimum registered capital, payment deadlines, down-payment ratio and cash ratio of registered capital. These pro-business policies have resulted in a spurt of growth in new businesses. From March to August about 1.93 million businesses were registered, up 61 percent year-on-year, providing a solid base for employment.

The success will encourage the government to continue on this path. Government approvals on business transactions and investment in non-strategic sectors will be further reduced, and the approval system will be ultimately transformed into a registration system.

Trade clearance procedures including product checks will be simplified and become faster.

Another possible area for deregulation will be overseas investment by individuals and companies. Capital requirements will be reduced, government approvals simplified, foreign exchange restrictions loosened and overseas investment in the yuan encouraged.

As for the market maintaining fairness, Li made it clear in Tianjin that this is a major responsibility of the government. He also advanced the idea of a "responsibility list" for the government, a list of "must-dos authorized by the law".

This means the government, ideally, will reduce its intervention in the marketplace and focus on ensuring a fair market so everyone can compete equally. Apparently, the recent crackdown on monopolies is a major part of the "responsibility list". Another item on the list is better intellectual property rights protection.

By curbing monopolies and protecting creativity, Li aims to achieve what he has called "mass creativity and mass entrepreneurship", paving the way for invigorating the Chinese economy through structural changes.

In this sense, it is expected more antitrust investigations will be undertaken and a special campaign featuring hefty penalties on violators of intellectual property rights will be put in place.

Another focus for Li will be money supply, as the Chinese economy is still sensitive to credit fluctuations. But the top policymakers are not going to repeat the old practice of simply injecting money into the market. Instead, they prefer to optimize the structure of the money market to let liquidity better serve real-economy sectors and small businesses. Following that logic, liquidity will not be greatly loosened but at the same time more reform measures in the financial sector will be advanced.

These measures may include allowing more private companies to set up banks, advancing deposit rate reform and regulating Internet financial institutions.

Recently, United States and European Union chambers of commerce in China have said surveys have found their members say they feel less welcomed in China.

In Tianjin, Li tried to soothe their worries by saying the antitrust drive did not target any specific group.

Only 10 percent of companies subject to antitrust investigations since China's Anti-Monopoly Law took effect in 2008 were foreign companies, he said, adding that China's door was always open to the world.

But given what he stressed during the summit, it is clear that not all foreign investors can win big in China, which is increasingly selective in foreign investment.

At the summit, Li highlighted creativity, "high-quality" urbanization and environmental protection. This shows China will be more than glad to welcome foreign investors who can bring know-how and high technologies to China.

But the days have gone for foreign companies to make big gains with market dominance and technologies that have been out in their home markets for decades.

Foreign investors need to refresh their mindset to ride the tide of a changing environment. If they reposition themselves and rebuild their advantages with state-of-the-art technologies and attend to Chinese laws, they can still beat most of their local counterparts with ease.

But for investors in labor-intensive industries who have enjoyed the advantage of low production costs, cheap labor and cheap land, it is probably time to get out of China.

The author is a Shanghai-based financial analyst. The views do not necessarily reflect those of China Daily.