Slack property market takes toll on services

Main HSBC performance index for July ebbs to lowest point in 9 years

China's weakening property market took its toll on the nation's service sector, as a private gauge of service activity sank to a nine-year low.

The Purchasing Managers Index for the service sector, jointly released by HSBC Holdings Plc and Markit Ltd on Tuesday, fell to 50 in July from 53.1 in June, the lowest reading since November 2005 when the survey began.

The figure indicated a stagnation of service activity last month. A reading above 50 indicates an expansion in activity while one below points to a contraction.

"The weakness in the headline number likely reflects the impact of the ongoing property slowdown in many cities as property-related activity, such as agencies and residential services, saw less business," said HSBC's China chief economist Qu Hongbin.

"The data point to the need for continued policy support to offset the drag from the property correction and consolidate economic recovery," Qu said.

The real estate sector accounted for 15 percent of GDP in 2012, according to an International Monetary Fund estimate. The property sector affects manufacturing industries such as cement and steel, as well as service industries such as real estate agents, interior furnishing and banking.

The IMF has warned that the correction in the property industry could depress GDP growth by a full percentage point.

Home prices dropped for the third consecutive month in July, according to a survey of 100 major cities released by the China Real Estate Index System, a property market data provider. Among the 100 cities, 76 recorded price declines and 24 had increases, despite the fact that 60 percent of the 46 cities that had property curbs had eased them to boost demand.

Liu Xuezhi, a researcher with Bank of Communications Ltd, agreed that the sagging property market was the chief reason behind the weakening PMI data.

"Exacerbated by lower credit support from the banks, China's property market began a serious correction in the second quarter. Now, the impact on many related businesses has started to become apparent," he said.

Liu noted that the official services PMI had declined for a second consecutive month. A survey by the National Bureau of Statistics found that services activity, as measured by the index, slowed to 54.2 in July from 55 in June and 55.5 in May. The official PMI is weighted more toward large State-owned enterprises.

Responding to the unexpected fall in the services PMI, the Shanghai Composite Index on Tuesday fell 0.2 percent to 2,219.95 points, after jumping 1.7 percent a day earlier.

China Vanke Co slid 2.1 percent in Shenzhen after sales dropped to 13.3 billion yuan ($2.15 billion) in July from 19.4 billion in June. Poly Real Estate Group Co retreated 1.7 percent. A measure of developers in the Shanghai index dropped 0.8 percent.

A major reason for the rally in the stock market last week was the upbeat manufacturing data. In July, both the official manufacturing PMI and the HSBC/Markit index reached their highest levels in many months. But even those numbers contained cause for concern.

A report by the macroeconomic research team at China Merchants Bank Co Ltd said despite rallying manufacturing PMI data, the recovery remained fragile. Sub-indexes of the PMI showed that companies are cautious about increasing inventories and staff, and cement and electricity production showed signs of weakness.

zhengyangpeng@chinadaily.com.cn

|

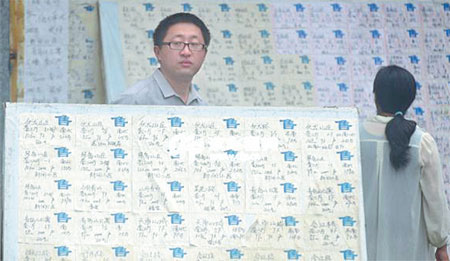

A housing brokerage promotes secondhand homes for sale in Qingdao, Shandong province. Experts said the nation's sagging property market was one of the main reasons behind the weakening non-manufacturing PMI data. Provided to China Daily |