Demand for iron ore and steel to rise in coming years

Although China's economic growth is slowing down, ongoing urbanization will still strongly support demand for iron ore and steel products for a long time.

"We have confidence in China's iron ore demand because its urbanization requires a large amount of steel products in the coming years," said Neville Power, chief executive officer of Fortescue Metals Group Ltd, the third-biggest iron ore producer in Australia.

He told China Daily in an interview that the company's contracts with Chinese steel mills are steady.

Based on the huge benchmark iron ore demand from China, even if it increases at a slower rate in future, is still a big number, said Power.

The view is shared with top officials of other international mining giants.

Sam Walsh, chief executive of the Anglo-Australian mining giant Rio Tinto Plc, said: "The growth in China is still there." He was speaking during a British Chamber of Commerce luncheon in Western Australia's Perth.

During his fourth visit to China last month, he told China Daily that based on the close and solid relationship with China, Rio Tinto will continue to provide a large amount of raw materials to the Chinese market for its industrialization and urbanization process.

"China is our most important market," said Walsh. "Our strategy regarding China will not change."

The company will continue to expand its iron ore capacity in Western Australia to meet growing demand from China.

He regarded China as the key driver of iron ore demand because of its continued growth and ongoing urbanization.

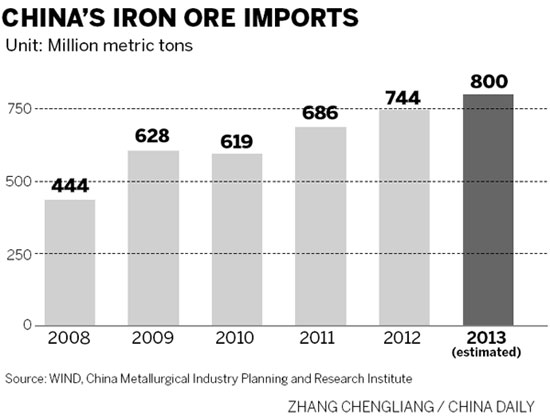

Li Xinchuang, head of the China Metallurgical Industry Planning and Research Institute, estimated earlier this month that China will import 850 million metric tons of iron ore in 2014.

He estimated 2013's iron ore imports will total 800 million metric tons, up 7.5 percent, accounting for about 70 percent of the country's iron ore demand.

"China's iron ore imports will continue to increase, but with a slower rate in the coming years," said Xu Xiangchun, information director of Mysteel.com, a steel industry consultancy company based in Shanghai.

Chinese steel companies have been suffering from the rising raw material costs and falling product prices in the past two years, which resulted in deficits for most steel producers in the last year.

However, urbanization also brought into the limelight certain steel companies such as producers of steel products for construction.

The use of steel structures in building construction has many advantages including water-saving and lower construction noise and dust compared with widely used concrete structures.

In addition, steel structures are lighter than concrete. They also produce less waste when the buildings are torn down to be recycled.

"The so-called 'green' construction has a big potential market for steel structure companies because the material is light but of high-quality," said Shan Yinmu, president of Zhejiang Hangxiao Steel Structure Co Ltd, China's first listed architectural steel structure company. "Construction of steel-structured buildings is an effective way to reduce construction waste and protect the environment."

Steel products are recyclable and do not produce much emissions as concrete does.

According to data from the National Development and Reform Commission, China will invest at least 1.5 trillion yuan ($247 billion) on energy-saving construction projects by 2020.

The construction sector accounts for one-third of the social energy consumption. At present, only 1 percent of the national area of structure has reached a "green" standard.

"Green construction buildings are a trend for cities in the future. They will bring new business opportunities and challenges to steel structure companies," said Shan.

dujuan@chinadaily.com.cn