UAE's 'oasis' woos Shenzhen home buyers

Updated: 2015-11-25 08:04

By Zhou Mo in Shenzhen(HK Edition)

|

|||||||||

|

Tourists use their smartphones to record the water fountain show outside the Dubai Mall in Dubai, United Arab Emirates. According to the Dubai Land Department, total Chinese investment in the emirate's real-estate sector hit 2.24 billion yuan ($350.4 million) in 2014, representing an increase of more than 300 percent over the previous year. Jasper Juinen / Bloomberg |

Dubai - dubbed the "futuristic oasis" of the United Arab Emirates (UAE) - knows where the gold is, having jumped on the bandwagon to lure affluent mainland Chinese who have been snapping up expensive real estate all over the world.

The rich Middle Eastern city, which already boasts as one of the biggest tech hubs in that region, has now trained its sights on Shenzhen residents seeking to invest in properties overseas.

Shenzhen-based real-estate agency Qfang.com has signed an agreement with DAMAC Properties, Dubai's luxury real estate developer, to promote property sales in the global metropolis.

Shenzhen investors will be offered the choice of purchasing hotels, luxury apartments or villas priced from 1.3 million yuan ($203,426.9) to 20 million yuan.

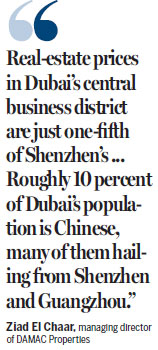

Ziad El Chaar, managing director of DAMAC Properties, said Dubai's property prices are much lower than those of Shenzhen and with a high rate of return of up to 8 percent, surpassing that of the US or Canada.

"Real-estate prices in Dubai's central business district are just one-fifth of Shenzhen's," he said.

Such an incentive should appeal to a big number of Shenzhen property investors who are unsettled by the local housing market trend following the latest round of price hikes between April and June.

Average prices of new residential projects in Shenzhen had soared by 31 percent year-on-year in June to 30,713 yuan per square meter after the central bank lifted its loans policy in late March, although the growth rate has slowed since July, according to the Urban Planning, Land and Resources Commission of Shenzhen Municipality.

Last month, the city's average prices of new homes fell 7.2 percent on a monthly basis to 33,599 yuan per square meter, but still up significantly from those of a year ago.

Hong Kong investors have also been attracted by Dubai's more affordable property sector. A report by real-estate services provider Savills says that while prices for high-end housing in Hong Kong reached $4,000 per square foot last year, it was only $1,000 in Dubai.

According to the Dubai Land Department, total Chinese investment in the emirate's real-estate sector hit 2.24 billion yuan in 2014, representing an increase of more than 300 percent over the previous year.

El Chaar said roughly 10 percent of Dubai's population is Chinese, many of them hailing from Shenzhen and Guangzhou.

Simon Jia, chief executive officer of new real estate business division at Qfang.com, said Shenzhen stands as a good place to promote overseas investment.

"People in Shenzhen, most of who are from other mainland cities, tend to accept new markets easily, are more willing to invest and possess richer investment experience. Shenzhen also has a large base of high-net-worth individuals and the middle class, who form the mainstream of the city's population," Jia said.

Data from Dubai's tourism department show that the city hosted more than 13 million tourists last year, and the number is growing at an annual rate of 2 percent. The number of Chinese visitors to Dubai rose by 25 percent to about 276,000 in 2014.

sally@chinadailyhk.com

(HK Edition 11/25/2015 page8)