Mortgage rate hikes to help cool down property market: analysts

Updated: 2011-03-15 07:06

By George Ng(HK Edition)

|

|||||||||

|

Central, Hong Kong. Major mortgage loan providers raised their interest rates for Hibor-based mortgage loans. Mike Clarke / AFP |

HSBC, BOCHK and DBS lift interest rates over the weekend

Banks operating in the city are raising their mortgage interest rates as cost of funds increase, a move that will likely help cool down the over-heating property market according to some analysts.

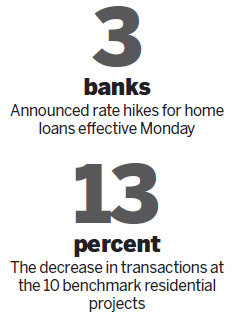

Major mortgage loan providers including HSBC, Bank of China (Hong Kong) and DBS announced over the weekend hikes in their interest rates for Hibor-based mortgage loans effective March 14.

After the adjustments, the mortgage rates of HSBC are in a range between 1.17 and 1.57 percent, up from a range between 1.07 and 1.27 percent previously while that of BOC (HK) has risen to 1.17-1.47 percent from 1.07 percent.

"The moves by major mortgage loan providers to raise their Hibor-based rates herald the beginning of a new rate-hike cycle," said Buggle Lau, chief analyst at Midland Realty.

He expects more players in the market to follow suit, citing the gradual tightening of liquidity in the market. This view is shared by Paul Lee, a senior banking analyst at Haitong International Research Limited.

"Odds for further hikes in mortgage rates are high as liquidity is tightening up," Lee said, noting that there have been strong signs indicating outflows of money from emerging markets including Hong Kong.

Expectations for an accelerated recovery in the economy this year and the relatively strong performance of Wall Street and major equity markets in Europe this year have triggered an outflow of liquidity from emerging markets as indicated by the general weakness in stock markets in the region recently, market watchers have suggested.

Meanwhile, Beijing's persistent monetary tightening moves in its fight against soaring inflation - including a series of hikes in the reserve requirement ratio and interest rates - have diverted many mainland companies to Hong Kong for their cash needs, further draining liquidity in the local market, Lee said.

"Loan demands are rising at a pace faster than that of deposits," he said.

Given the fact that commercial loans (to companies) generate much higher net interest margins (NIM) as compared with mortgage loans, banks are no longer willing to offer mortgage loans at the extremely low Hibor-based rates, the analyst said.

Hang Seng Bank, another major player in the local mortgage market, was a step ahead of its peers after it announced in late February that it was to phase out its Hibor-based rates.

The prospect of further hikes in mortgage rates has reined in sentiment in the residential market. Transactions at the 10 benchmark residential projects during the past weekend fell about 13 percent compared with the previous weekend, according to data from Centaline Property Agency, one of two major real estate agencies in the city.

"I don't expect a major correction in the property market immediately due to a single factor (mortgage hikes). But you need to consider other factors," Midland Realty's Lau said.

Coupled with the fact that the Hong Kong government is striving to significantly boost land supply for residential development, the rate hike moves could help cool down the property market, he said.

Haitong's Lee also believes that the rate hikes will serve as a coolant to the red-hot residential property market. "I believe Hibor-based rates will continue to rise, which will benefit banks in terms of a higher NIM while helping to cool down the property market," he said.

Home prices in the city have risen more than 60 percent since the beginning of 2009, as ample liquidity, historically low mortgage rates and an influx of wealthy buyers from the mainland have aggravated short supply.

China Daily

(HK Edition 03/15/2011 page2)