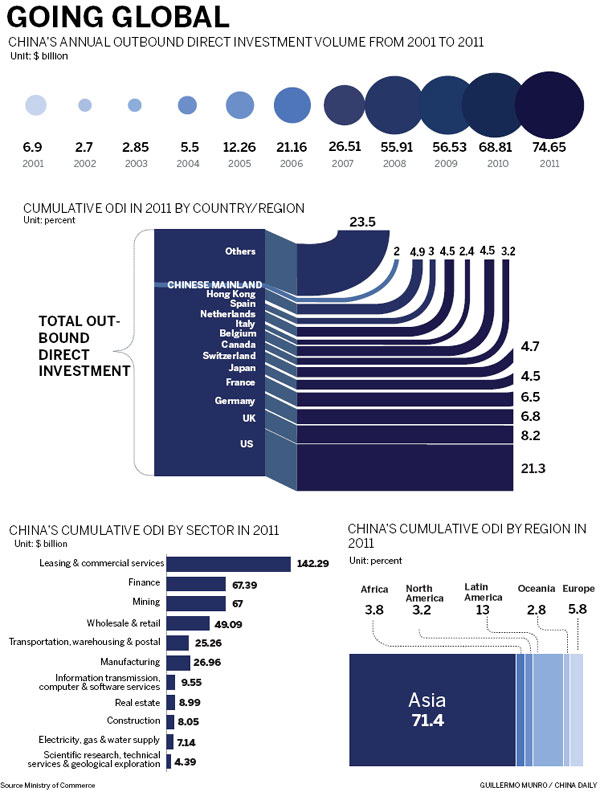

Total outbound direct investment rises 8.5 percent to $74.65b in 2011

Officials from the Ministry of Commence responsible for growing Chinese investment around the world are urging the international business community to be more "tolerant and rational" toward ambitious Chinese companies seeking to invest overseas.

Speaking at the release of the latest figures on outbound direct investment, Shi Ziming, commercial counselor at the ministry's Department of Outward Investment and Economic Cooperation, said many international markets still misunderstood the motives behind Chinese companies making investments overseas.

Shi said there should be much more objective recognition and evaluation of any proposal being made by a Chinese company seeking to make an investment, given their strong track record in terms of local job creation and other economic contributions to the organizations and communities in which they invest.

"Chinese companies overseas are not only contributors of a lot of jobs and taxes for the foreign local communities, but also providers of quality services and products," said Shi.

The latest Statistical Bulletin of China's Outbound Foreign Direct Investment showed that Chinese non-financial ODI surged by 14 percent in 2011 from a year earlier to $68.58 billion.

Shi added the department remained "upbeat about the outlook for the nation's ODI in the years ahead, and the high-speed growth momentum could be sustained", but added: "We hope that foreign nations should be more tolerant and rational toward Chinese companies making overseas investments."

The revised figures were an improvement on those announced earlier in the year by the ministry, which had been set at $60 billion.

China's total ODI gained 8.5 percent year-on-year to $74.65 billion, which makes China the sixth largest investing nation, in terms of the value worldwide.

About 36 percent of Chinese ODI last year was realized through mergers and acquisitions, particularly in mining, manufacturing, and electricity production and supply.

The report showed that the momentum had been maintained into this year, with ODI during the first seven months in the non-financial sector increasing 52.8 percent from a year earlier, driven by growth of capital flow into ASEAN member countries and the United States, which represented 36 and 29.6 percent of the total respectively.

The largest investment deal by a Chinese company by value this year was in May, when Dalian Wanda Group, China's largest entertainment group, agreed to buy AMC Entertainment Holdings Inc for $2.6 billion including debt, as it expanded into the US.

However, despite the positive growth, officials said the scale of Chinese ODI remains relatively small compared with developed economies globally.

In 2011, China's ODI by value accounted for just 4.4 percent of the global total, meaning "China still lags far behind developed economies in investing overseas", said Shi.

Lu Zhengwei, chief economist at Industrial Bank, said he considered the figures as showing China is poised for a period during which its ODI would "explode".

"Chinese companies are strongly capitalized and highly motivated. These two factors make it possible for the growth trend to last for years," said Lu.

However, Shi said that as China's ODI picks up, doubts and misconceptions remain in some foreign markets about the investment intentions of the Chinese government and individual companies.

Both developing economies including India and developed economies represented by the United States and the European Union have set restrictions, sometimes citing security and political concerns, which have blocked Chinese investment in some cases.

An example is the failed $18.5 billion bid in 2005 by the country's leading offshore oil producer CNOOC for California-based Unocal Corp, which faltered due to heavy opposition from the US government.

And in the same year, India's blocking of a bid by Huawei Technologies Co Ltd to expand into that market on security concerns, attracted similar international attention.

Shi said China too often remains "misunderstood", and that there should be as much "objective recognition and evaluation" given to Chinese bids, as there would be to those from local investors.

In 2011, Chinese companies that owned operations overseas submitted local taxes of more than $22 billion, creating jobs for as many as 1.22 million people, including 888,000 local jobs, said the report.

Chinese companies created 100,000 jobs in developed economies.

"China's rise as the second-largest economy makes many foreign countries feel threatened, and some are especially fearful of investments by Chinese State-owned enterprises, which they wrongly believe are being made on behalf of the Chinese government," added Lu.

He suggested that the Chinese government simplify relevant procedures on approving ODI deals, and "Chinese companies should prioritize localizing their businesses and getting acquainted with local rules and regulations", when investments are being proposed, he said.

By the end of 2011, China's cumulative ODI had reached $424.78 billion, accounting for only 2 percent of the global total.

More than 13,500 Chinese companies had set up 18,000 overseas branches, factories or offices by the end of 2011, across key sectors including commercial services, finance, mining, and manufacturing in 177 nations and regions.

Just over 71 percent of China's cumulative ODI by 2011 was allocated in Asia-Pacific, with 11 percent going to developed economies.

State-owned enterprises were the major drivers, contributing 90 percent of China's ODI value.

As part of the 12th Five-Year Plan (2011-15), the Chinese government has vowed to encourage more Chinese companies to invest overseas, as well as welcoming more foreign companies to invest in China.

In his annual Government Work Report, Premier Wen Jiabao pointed out that China encourages domestic companies of all types to invest overseas through mergers and acquisitions, especially in the energy, raw materials, manufacturing and service sectors.

"The Chinese government has played a key role in launching and implementing policies, providing appropriate services and helping domestic companies control the possible risks," said Shi.

One of the most common accusations made against Chinese ODI has involved investment in the energy and minerals industries, where critics have suggested Chinese companies are simple grabbing resources.

But in fact commercial services top the list of target sectors.

By the end of 2011, about 33.5 percent of China's cumulative investment went to commercial services, and the mining industry accounted for just 19.4 percent by value.

And the statistics showed that Chinese companies are diversifying the regions in which they invest, and are not focusing on African investments, as many critics have suggested.

In his meeting with visiting German Chancellor Angela Merkel, Premier Wen said Chinese companies remain keen to invest and participate in infrastructure projects across Europe.

But as uncertainties remain over the global economy and the eruozone debt crisis, "it's hard to tell whether now is the best time for the Chinese companies and investors to buy abroad", said Wang Chunying, head of the Balance of Payments Department with the State Administration of Foreign Exchange.

dingqingfen@chinadaily.com.cn

(China Daily 08/31/2012 page13)