Zhao Wei, husband banned from capital markets for 5 years

|

|

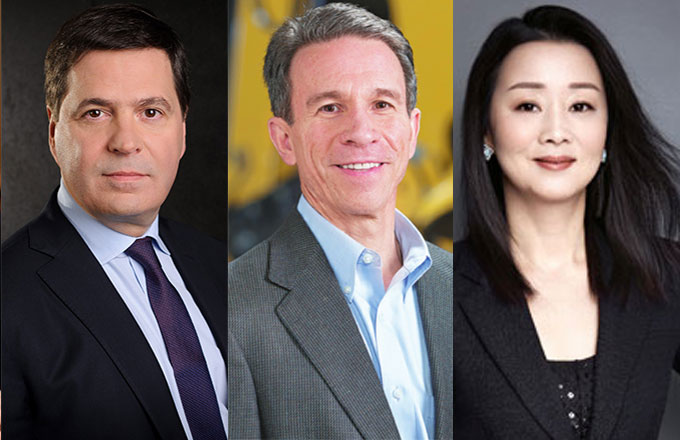

Actress Zhao Wei, member of Venezia 73 International Jury, poses for photographers during a photocall at the 73rd Venice Film Festival in Venice, Italy, Aug 31, 2016. [Photo/VCG] |

Billionaire actress Zhao Wei and her husband Huang Youlong have been banned from China's securities markets for five years for market violations, according to a filing by Zhejiang Sunriver Culture Co, which Zhao's company sought to acquire in February this year but failed.

Zhao and Huang were given a 300,000 yuan ($45,180) fine each, it said.

Forty-one-year-old Zhao is widely known not only as a celebrity in the entertainment industry but also as an investor. She and her husband hold wealth of more than 5 billion yuan ($753 million), according to a regulatory filing earlier this year.

The penalty and market ban were imposed on the couple after the China Securities Regulatory Commission (CSRC) investigated Zhao's proposed acquisition, the filing said.

Zhao's company had been planning to acquire Zhejiang Sunriver Culture Co since late 2016, when it was then named Zhejiang Wanjia Co, a Shanghai-listed company, with self-owned funds of 60 million yuan and 3 billion yuan funding leveraged from other firms.

According to the filings to the Shanghai Stock Exchange at that time, Zhao wished to acquire some 30 percent stake of Zhejiang Wanjia Co.

While Wanjia's capitalization was about 10 billion yuan, Zhao's company-Longwei Culture and Media-h(huán)ad registered capital of only 2 million yuan. Longwei aborted the deal in March, causing significant fluctuation in the share prices of Zhejiang Wanjia.

CSRC said that Zhao's company attempted to acquire a listed company using a shell entity, and made announcements that were misleading the market and investors.

Zhao's company had insufficient self-owned funds, and financing from other companies was uncertain. However, Zhao's company released a series of announcements about the acquisition plan that was not matching the actual situation, violating information disclosure rules through false documents, CSRC said.

The moves have harmed market equality, transparency, and investors' sentiments and confidence in the securities market, said CSRC.

According to China's securities law, the five-year ban from the securities market means that during the next five days, Zhao and her husband need to resign from all senior executive posts they hold in listed companies, and they can't operate in securities-related businesses such as being brokers or underwriters for five years.

"Their rights to trade stocks in the secondary market are not limited," said Ma Yu, a consultant with Shanghai Shenhong Law Firm.

Cheng Yimin, chief analyst for China Post Securities, said the ban and the fine shows regulators' dedication to improve trading conditions in the securities market.

The punishment is in alignment with existing rules and laws. It shows that regulators are determined to deleverage financing in acquisitions, said Cheng.