Capacity cut remains priority despite coal price rises

|

|

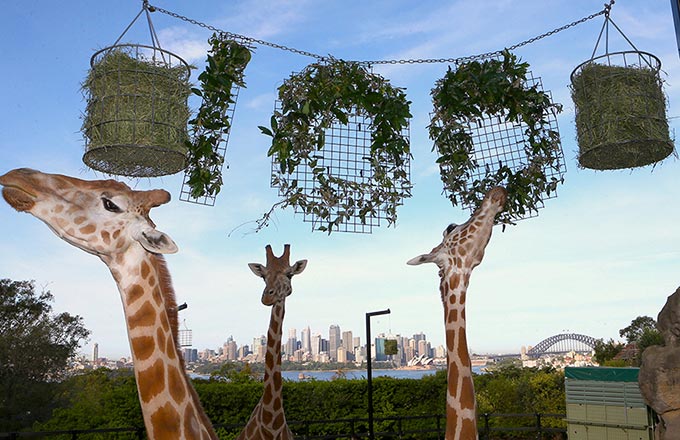

A man repairs equipment at the Wanglou Mine in Jining, Shandong province. [Provided to China Daily] |

BEIJING - A short-term supply shortage has buoyed up coal prices in China, but the change is not expected to disrupt the government's long-term goal of reducing overcapacity in the sector.

Coal producers led a rally on China's stock market on Monday as shares of all 33 coal companies traded on the stock exchanges increased, and five surged by the daily limit of 10 percent.

The rises followed rapid coal price increases in the past few weeks amid a government campaign to cut ineffective production, accompanied by recovering coal demand due to a stabilizing economy and the onset of winter.

The Bohai-Rim Steam-Coal Price Index, a government-backed gauge of coal prices in northern China's major coal ports, rose to 577 yuan ($85.1) per ton last week, the highest since the start of the year.

China's coal price index has climbed for four consecutive months since June, reaching 414.07 in September, up 11.99 percent month on month and 22.71 percent from a year earlier, according to the National Development and Reform Commission (NDRC).

Huang Teng, a coal industry expert with the Beijing-based consulting firm CLT, attributed the price hikes to a short-term mismatch between supply and demand.

The latest market rebound was a correction of previous downward movement and will not change the long-term oversupply trend, said Xing Lei, a researcher at the Central University of Finance and Economics.

China is the world's largest consumer of coal. The industry has long been plagued by overcapacity and has felt the pinch over the past two years as the economy cooled and demand fell.

During the first eight months of the year, China's coal output fell 10.2 percent year on year to 2.18 billion tons, and the government aims to cut more capacity to upgrade the industry and reduce carbon emissions.

In the meantime, China's economy has showed signs of improvement in recent months, with the manufacturing sector expanding and the property market booming, leading to higher coal consumption.

As rising coal prices hurt the profits of the downstream power-industry and threatened the supply for winter heating, central and local governments since late September have held a series of coal-production management meetings to ensure market supply.

The NDRC has pledged to increase supply without weakening capacity-cutting efforts.

Last month, it decided to relax the limit on production days for efficient coal producers, with the former 260-day cap increasing to a maximum of 330 days. The original limit, had it been followed, would have cut production by over 500 million tons in 2016.

As of mid-October, coal inventories in major power plants had increased 22.7 percent from the end of August to 62.3 million tons, NDRC deputy secretary-general Xu Kunlin said Tuesday.

In the longer term, China's coal supply will continue to be excessive due to the development of clean energy and the green economy, and it will remain an arduous task to reduce capacity and upgrade the industry, Xu told reporters.

By 2020, China's coal consumption will reach 4.1 billion tons at most, while its coal production capacity will hit 4.6 billion tons even if capacity reduction goals are achieved, Xu said.

The outlook requires the country to continue capacity-cutting efforts and the structural overhaul of the coal industry, Xing said.

China plans to cut coal capacity by half a billion tons in the next few years, with vast funds set aside to help displaced workers. This year, the government aims to slash capacity by 250 million tons.

By the end of September, China had accomplished over 80 percent of its annual coal capacity reduction goal, according to the NDRC.