|

|

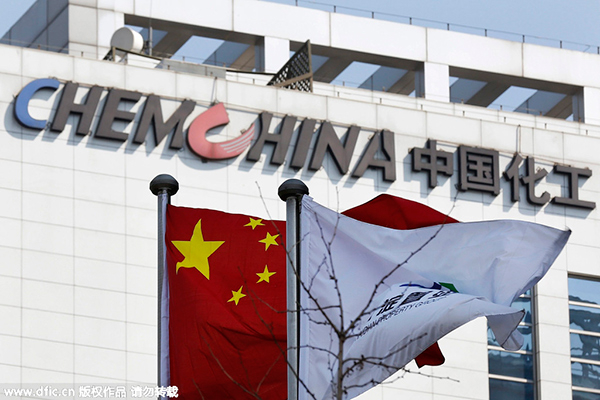

A Chinese national flag and a company flag fly in front the logo of China National Chemical Corporation at the company's headquarters in Beijing, Mar 24, 2015. [Photo/IC] |

$43 billion deal to acquire chemical company Syngenta expected to close by end of year

China National Chemical Corp on Monday received approval from US national security officials for its $43 billion takeover of Swiss chemical company Syngenta AG.

The Committee on Foreign Investment in the US has cleared the transaction, the companies said in a statement. The deal, expected to be completed by the end of the year, is still subject to antitrust review by regulators worldwide, according to the statement.

But getting the nod from CFIUS, a US interagency committee that has the power to block deals deemed to be posing a threat to national security, removes one of the biggest hurdles for the massive deal.

Analysts said that acquiring Syngenta, which got more than a quarter of its revenue last year from seeds and crop protection in North America, would help transform ChemChina into a pesticide and agrochemical giant.

The bid is leading a record wave of Chinese acquisitions that has prompted US officials to consider claims that some purchases could threaten national security.

CFIUS, led by the Treasury Department and including officials from the Defense and State departments, reviews acquisitions of US businesses by foreign investors for risks to US security and can recommend to the president that deals be stopped.

The committee often imposes conditions on transactions before clearing them, such as restricting the foreign company's access to parts of the US business.

Approval by the CFIUS may trigger criticism in the US. A group of farm-state senators in March called on the Treasury Department to closely scrutinize the Syngenta takeover, saying it could affect food security and safety as well as the US farm sector.

In June, Senator Chuck Grassley, a Republican from Iowa, called the deal "concerning" and said the US needed to consider "strategic questions" before approving the sale of agricultural assets to foreign governments.

Reuters earlier reported the expected clearance, citing unidentified people. The mega-deal is expected to close by the end of the year.

Bloomberg