|

|

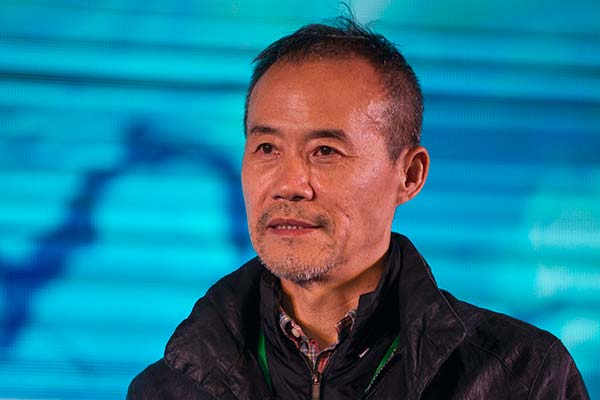

Wang Shi, chairman of China Vanke Co, attends the SEE Foundation World Water Day Forum at Guangzhou Tower in Guangzhou, China, March 22, 2016 .[Photo/VCG] |

Real estate giant urges watchdogs to investigate asset management plans of Baoneng Group

Real estate giant China Vanke Co Ltd is accusing its largest shareholder Baoneng Group of illegal acts and insufficient disclosure of stock ownership moves, warning of an upsurge in the battle for control of the company.

Vanke has asked the China Securities Regulatory Commission and the Shenzhen Stock Exchange to probe into the asset management plans, or AMPs, of Shenzhen Jushenghua Co Ltd, an arm of Baoneng Group, on Monday for alleged illegal acts and insufficient disclosure, according to the filing released by the Shenzhen-based developer.

If the accusation is true, Vanke's stock price will continue to be under pressure, said Jeffrey Gao, head of Nomura China Property Equity Research.

However, it is difficult to predict the result, because the lawyers need time to investigate the contracts of AMPs, a term referring to a type of shadow-banking arrangement to purchase stock in China, to find the ultimate beneficiaries, said a lawyer who declined to be named.

The source said that this is "more than a legal issue".

"Since last year we have seen the invisible power of the two sides, and even among the regulators. This time it is likely to be an effective mechanism for the nation's watchdogs to accelerate the transformation pace, namely the CSRC, the China Banking Regulatory Commission and the China Insurance Regulatory Commission," he added.

Baoneng holds a 25.4 percent stake in Vanke via nine asset-management plans in an attempted "takeover", according to the letter filed by Vanke.

The biggest property developer said that Jushenghua has no legal rights to finance through these vehicles, which came under regulatory scrutiny last year, alleging that they are not eligible for being registered as shareholders under the country's laws.

It is estimated that Baoneng used 43 billion yuan ($6.4 billion) to buy Vanke's stakes, among which nearly 60 percent was borrowed from six banks through AMPs, wrote JPMorgan Chase & Co analysts led by Katherine Lei in a July 12 note.

Six out of nine AMPs are sitting on floating losses. If Baoneng were unable to finance to add more cash to them, the positions of such products with high leverage may be compulsorily closed, said an investment manager working at a State-owned investment corporation, who declined to be named.

"Obviously Vanke wants to force out its opponent," he said. "If Baoneng Group has acted improperly and fails to finance, then 'game over': the funds will be liquidated. State-owned enterprises and regulators who are involved in the tussle will see personnel changes, and Vanke's head Wang Shi is likely to step aside. "