BEIJING - China's economic growth will moderate further in the next two years as domestic demand is weakened by the property downturn, UBS has forecast.

"We forecast China's GDP growth to slow to 6.8 percent in 2015 and 6.5 percent in 2016. This slowdown is mainly driven by the ongoing property downturn," Wang Tao, chief China economist with UBS, said in a research note on Tuesday.

The property downturn is expected to drag down domestic demand through softer construction, weaker heavy industry production and investment, smaller local government financing and slower income growth, Wang added.

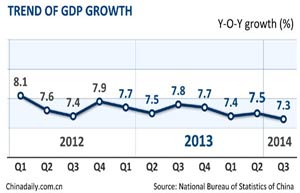

China's GDP expanded 7.3 percent from a year ago in the third quarter, compared with 7.5 percent in the second quarter and 7.4 percent in the first quarter of this year, official data showed.

The average price of a new home in 100 major Chinese cities in October fell for the sixth-straight month, reaching 10,629 yuan ($1,738) per square meter, down 0.4 percent from September, statistics from China Index Academy (CIA) showed.

Given the seriousness of property downturn, Wang forecast that the government will continue to provide policy support in the coming year to mitigate the slowdown.

"The government may relax mortgage lending more significantly by lowering the still high down payment requirements and cutting mortgage lending rates. In addition, property related transaction taxes and fees may be lowered," she said.

A financial crisis is much less likely in the near term, given China's high domestic saving, largely closed capital account, government control of the banking system and a still manageable government debt level, Wang said.

|

|

|

|

|