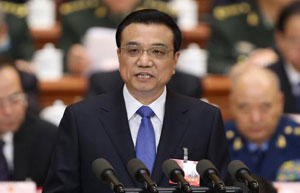

Premier Li Keqiang said China will step up its financial reforms with greater vigor to lower the cost of lending and ensure the stability of the "real economy".

In answer to questions from global banking leaders who met during the week in Tianjin, Li said in Beijing on Friday that the central government will widen access to financial markets to allow fair and equal competition, protect the interests of depositors by setting up a deposit insurance system and open up capital and currency markets in an orderly manner.

He said the country's financial reform has entered a new phase. It will continue to ease difficulties in lending for small and medium-size enterprises, promote grassroots entrepreneurship and ensure the healthy and sustainable development of the economy, he said.

Li also said China's financial regulations will be improved and strengthened to root out systemic and regional risks.

The pledges were made in Beijing on Friday, after the 18th International Conference of Banking Supervisors was held during the week in Tianjin.

Li said the global economy is still intricate and complex, and a certain degree of vulnerability remains in the global financial system.

"The real economy is the basis of finance, and the ongoing reforms of international financial regulations are aimed at stabilizing the global financial system and ensuring the healthy development of the real economy," he said.

Li said China is willing to work with the Basel committee and other countries to step up macro control and structural reform, as well as to promote the resilience of the financial system and improve risk tolerance.

The Basel Committee, located at the Bank for International Settlements in Basel, Switzerland, is composed of representatives of central banks around the world. The panel sets standards on many aspects of banking operations, such as capital adequacy ratios.

Stefan Ingves, chairman of the Basel Committee on Banking Supervision and governor of Sweden's central bank, said the Chinese economy and its financial reforms are proceeding well.

The committee and international financial regulators will strengthen cooperation with China to jointly protect the stability of global financial system, resist risks and support the real economy, he said.

|

|

| Li to inaugurate Tianjin Summer Davos | Broad changes coming in finance, premier says |