India's top automaker can thank China's appetite for a British off-road vehicle brand for the biggest drop in bond risk in the global industry.

Credit-default swaps insuring the debt of Tata Motors Ltd for five years slumped 97 basis points this year to 369, as a demand surge in the world's second-largest economy fueled the biggest profit jump since 2010. Similar contracts for Fiat SpA fell 90 basis points, according to data provider CMA.

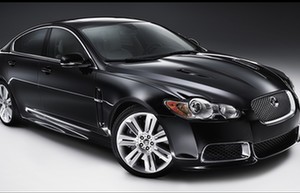

Sales at Tata Motors' Jaguar and Land Rover unit in China, the world's largest car market, soared 61 percent last quarter, helping the Indian company tide over a demand slump at home. The risk the carmaker will renege on debt in the coming 12 months has slumped to 0.09 percent, from 2.5 percent five years ago, according to Bloomberg's default risk model based on factors including share performance and debt metrics.

"The profitability just keeps surprising positively," said Max Warburton, auto analyst at Sanford C Bernstein in Singapore. "JLR is generating a huge amount of cash, and the business looks in great health."

The credit market's increased confidence in Tata Motors marks a turnaround from a deterioration after the sudden death of former managing director Karl Slym in January. Slym, who joined the Indian company from General Motors Co, died after falling from the 22nd floor of the Shangri-La hotel in Bangkok, in a case that Thai police have said pointed to suicide. The automaker's default swaps reached an 18-month high in February.

Tata Motors group's strong financial performance, despite the downturn in domestic business, buoyed by its luxury brands Jaguar and Land Rover, may have positively influenced its credit default swaps, Tata Motors' Mumbai-based spokeswoman Minari Shah said in an e-mail. The movement of the gauge may also be "guided by several external factors apart from company specific factors", she said.

The company's net income more than tripled from a year earlier to 54 billion rupees ($894 million) in the April-June period, beating the 37.9 billion rupee median of 34 analysts' estimates compiled by Bloomberg. Deutsche Bank AG and Credit Suisse Group AG raised their share-price targets for the maker of the Nano, the world's cheapest car, after the earnings announcement on Aug 11. Tata Motors bought JLR from Ford Motor Co in 2008 for more than $2 billion.

Cash and equivalents at the Mumbai-based company increased to 387 billion rupees from 109.5 billion rupees at the end of the financial year through March 2011, according to data compiled by Bloomberg. Its net debt, or liabilities minus cash, as a proportion of earnings before interest, taxes, depreciation and amortization was 0.67 as of March 31, the lowest at least since 2002.

While sales have risen at the Jaguar and Land Rover unit, Tata Motors has been grappling with weak demand at home amid India's economic slowdown. Domestic passenger-vehicle deliveries fell 37 percent last quarter, according to the Society of Indian Automobile Manufacturers.

The company is now stepping up efforts to turn around its local business, unveiling its first new car model in five years this month. The compact sedan, called the Zest, was developed to revive profitability at the Indian business as it lost market share to Maruti Suzuki India Ltd and the local unit of Seoul-based Hyundai Motor Co.

"We're quite positive on Tata Motors for the next few years," Juergen Maier, a fund manager in Vienna at Raiffeisen Capital Management, which oversees about $1.1 billion in emerging-market assets, said in a phone interview on Thursday. "Land Rover is still seeing huge demand, and we think that in the domestic business, the commercial vehicle business, things will turn around in the coming few years."

Indian Prime Minister Narendra Modi has pledged to revive Asia's third-largest economy after his landslide election victory in May. Growth declined to below 5 percent in the past two fiscal years from 9.6 percent in 2006-07.

Tata Motors issued 10-year rupee bonds this month at 9.81 percent, according to data compiled by Bloomberg.

|

|

|

| ?Discovering unexplored China with Land Rover | ?Jaguar to cut prices on 3 models in response to China's auto probe |