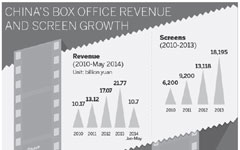

Box office spending in China is set to nearly double from $3.13 billion in 2013 to $5.9 billion by 2018, said a new report published by global consultancy firm PricewaterhouseCoopers.

Box office revenue will be the main growth driver for the filmed entertainment sector, accounting for more than 80 percent of total filmed entertainment revenue during the period, said the report released on Thursday.

|

|

|

"Affluent middle class will propel the growth in over 400 Chinese cities with a population of 100,000 or more. Cinemas are being built in increasing numbers and in mid-2013, China had approximately 15,000 screens and 3,700 theaters. However, this is still a tiny amount for a country with a population of 1.3 billion, while the US, with a much smaller population, has 40,000 screens. So the scope for growth is

"As more screens are rolled out across China, increasingly beyond top-tier cities, the number of film admissions is set to grow from 446 million tickets in 2013 to 642 million in 2018, a CAGR of 7.6 percent," said Kong. Advertising, the smallest part of the total revenue, has still managed to keep pace with the growth in box office revenue. Theater advertising is expected to increase at a compound annual growth rate of 12.8 percent to $133 million by 2018, up from $73 million in 2013, according to the PwC report. There are different forms of theater advertising, including pre-movie advertisements, attached advertisements and the advertising boards in the theaters. "Revenue from nationwide pre-movie advertisements grew from 1 billion yuan in 2012 to around 1.3 billion yuan in 2013, according to our estimates," said Shao Gang, deputy director of the consulting business for the entertainment industry at Horizon Research Consultancy Group. "I think in the future, pre-movie advertisements stand a better chance of growth as it involves less risks compared to film-specific advertisements," said Shao.