Yards chart new course with State Council policy

Moves announced recently by the State Council for upgrading the shipbuilding industry by 2015 will accelerate shipyards' integration and help the sector to navigate its difficulties, said experts.

The measures were released as the industry grapples with an unprecedented mix of challenges: low demand, declining orders, sliding prices and oversupply. The goal is to get Chinese shipbuilders back to sustainable development through restructuring and upgrading, said the State Council

"The new measures look to resolve overcapacity and low demand in the short term and set clear, long-term targets for industrial upgrading," said Yang Xinfa, deputy secretary-general of the China Association of the National Shipbuilding Industry.

The shipbuilding industry is directly related to 113 of the nation's 135 industries, and its health has an impact on key sectors including steel, equipment manufacturing, electronic information and others.

Huang Jin, deputy regional manager of DNV Maritime of China, part of the consultancy DNV Maritime and Oil & Gas Classification, said the council's plan showed the industry's importance. He said that he is looking forward to detailed measures from industry regulators and local governments.

The State Council plan urges local governments to support shipbuilders' innovation, strictly control new capacity, promote high-end products and stabilize the industry's international market share with greater funding support, according to the statement dated July 31.

Besides restricting new shipbuilding capacity, the government is encouraging mergers and acquisitions and pooling of resources in the industry, the statement said.

"Chinese shipbuilders are less competitive than their South Korean peers because they are less creative and less capable in meeting market requirements and client demand. The new measures recognize this weakness," said Huang.

But private-sector shipbuilders complain their financing difficulties persist.

Shipowners will get more favorable financing terms for placing orders for Chinese-made vessels, engines and axles, and some key companies will be allowed to issue bonds, according to the cabinet's announcement.

"Shipowners only have to make a small down payment for ship orders. Shipbuilders have to provide the rest of the financing during construction. Therefore, to my understanding, shipowners have better financing conditions than shipbuilders," said Li Aidong, president of Jiangsu Daoda Marine Heavy Industry Co Ltd.

According to Li, high financing costs have hurt private-sector shipbuilders' profit margins.

"Privately owned shipbuilders' financing costs are more than double those of State-owned companies, but I do not find any favorable policy in the document to help us in financing," said Li.

Su Baoliang, a CITIC Securities Co Ltd analyst, said support policies are less needed during a down market.

"The shipbuilding industry has entered into a low market cycle, and it is impossible to stop uncompetitive companies from going bankrupt. Instead, it is advisable to let the market play its full function and let the fittest survive."

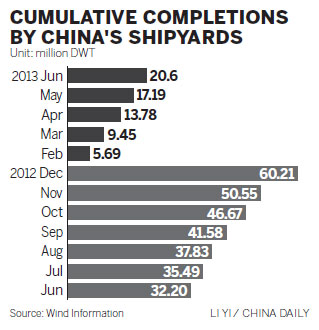

Figures from the Ministry of Industry and Information Technology show only 20.6 million deadweight tons of orders were completed in the first half nationwide, down 36 percent year-on-year.

Chinese shipbuilders' orders in hand dropped 13.4 percent to 108.98 million dwt as of the end of June.

Public information also shows the 80 major shipbuilding companies' core business revenue declined 22.4 percent to 84.1 billion yuan ($13.7 billion) from January to May.