Investors urged to think health

|

A private hospital in Changsha, Hunan province. Private hospitals have been growing rapidly in China and their number has increased by nearly 50 percent from 2008 to 2011. [Photo / Provided to China Daily]

|

Opportunities as opening-up of hospital sector enters golden era

The full opening-up of China's hospital market is providing huge opportunities for foreign investors although risks exist, according to an industrial report from The Boston Consulting Group.

China's hospital market is approaching a golden era of growth and ready to embrace additional private capital, including overseas funds, according to Chun Wu, partner and managing director of BCG Greater China and also co-author of the report.

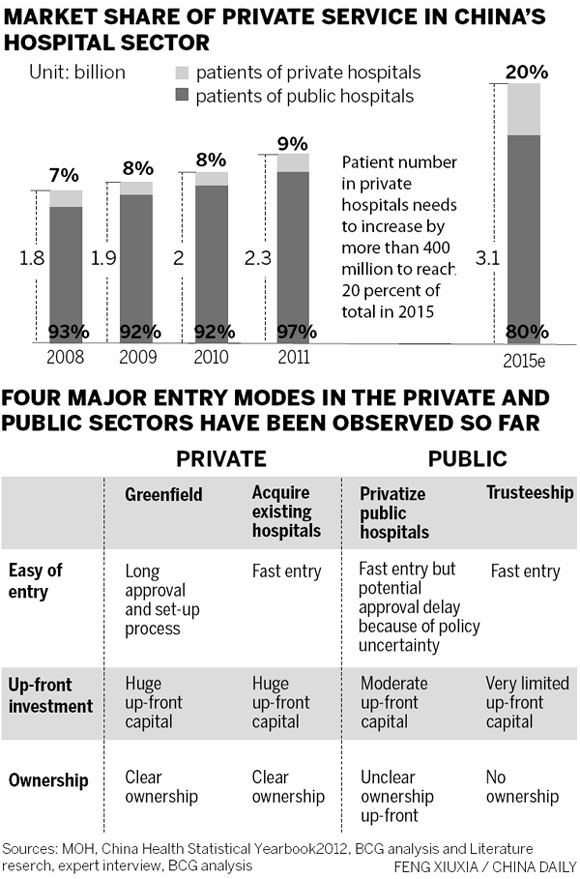

Total revenue for hospitals in China exceeded 1.25 trillion yuan ($204 million) in 2011. Private hospitals have been growing rapidly and the number of private hospitals has increased by nearly 50 percent from 2008 to 2011, statistics from the former Ministry of Health show. The Chinese government has set a goal to increase the private service contribution to the whole hospital industry to 20 percent by 2015 from less than 10 percent today.

"The investment opportunities in the hospital sector tend to emerge in waves," said Wu.

Different segments

Broadly speaking, there are several hospital segments that have investment potential. As private hospitals, there are high-end, specialty chains, general, extended care and group hospitals. In the public sector, there are general hospitals undergoing privatization.

In the short term and also taking place now, high-end and specialty chain hospitals are in the vanguard of the change. In the middle term - within three to five years - high-end and specialty chains will continue to thrive, while general hospitals, both private and public undergoing privatization, will become key investment opportunities. "We expect extended care will emerge in the medium to long term," said the report.

General hospitals will see further growth and large hospital groups should emerge through mergers and acquisitions and industry consolidation in the long term.

Investors need to be mindful of the development trends within each segment and develop a deep understanding of segment-specific requirements, the competitive landscape and key success factors in order to identify the best targets.

In the high-end hospital sector, the key to success is the patient-centric mindset that is based on a very fundamental understanding of the needs of target users, which is then reflected in the branding, service and talent requirements.

For specialty chain hospitals, operations that can be easily replicated are the cornerstone. Strong brand reputations and the ability to develop the talent pool are needed to fuel expansion. Players must develop relevant strengths according to the unique characteristics of each specialty segment, said the report.

General hospitals may be the most challenging. Comprehensive capabilities are required, ranging from obtaining policy support, general and specialty expertise development and getting the required talent, operation and process management potential in a transitional labor environment, rebranding or brand-building and, finally, maintaining sufficient scale.

Differentiated positioning and scalability enabled by standardization are strongly desired characteristics in the extended care segment. Easy access to patients from hospitals is also critical.

- Taobao offers free hospital appointments

- Advisers seeking a remedy for private hospitals

- Hospital reforms begin to take effect

- China bans entertainment venues near schools, hospitals

- Smaller hospitals 'offer huge opportunities'

- Growth of for-profit hospitals should be limited

- Beijing hospitals may hire senior executives from HK

- In Tianjin, luxury hospitality re-imagined