DUBAI - Gold prices gained $6.70 or 0.4 percent during the last week as the yellow metal's value was supported by Chinese gold imports which rose to a seven-month high in November 2012, said Gerhard Schubert, head of precious metals at bank Emirates NBD on Saturday.

In his weekly published commentary, Schubert said there was general expectation in the market that in China the demand for gold generally picks up before Christmas and will last till the Lunar New Year (February 2013). In addition, China reported a 14.1 percent year-on-year growth in exports for the month of December 2012. Rising trade figures usually trigger worries over an inflation surge which translates into higher gold prices.

On Saturday, Gold was trading at around $1,662?per ounce. That was 1.8 percent higher than on Jan 6 but slightly lower than $1, 680 the yellow metal briefly touched on Jan 9.

Schubert said that yellow metal, albeit on a rebound, could not sustain early 2013 momentum because of inflation data from China, which was highest in the last seven months. "This led investors to book gains on gold," said Schubert.

Other factors that supported gold, which is regarded as an investment for protection against inflation, were the European Central bank's decision to keep interest rates steady.

Related Readings

Demand for gold rises as central banks diversify reserve holdings

China's top gold producer's sales up 27% in 2012

China remains largest gold producer for 6th year

Gold demand to recover in Q4: experts

'Cat model' to dazzle Shanghai auto show 2013

'Cat model' to dazzle Shanghai auto show 2013

Models at Tokyo modified car show

Models at Tokyo modified car show

Shanghai Fashion Week focuses on domestic brands

Shanghai Fashion Week focuses on domestic brands

Angel-dress models at Shandong auto show

Angel-dress models at Shandong auto show

Safe and Sound

Safe and Sound

Theater firms scramble for managers

Theater firms scramble for managers

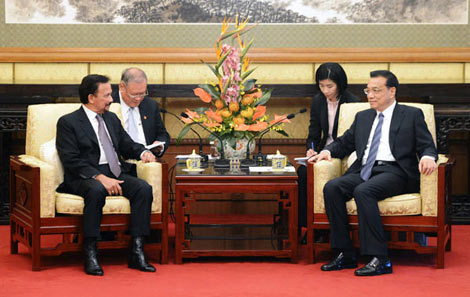

Premier pledges closer ties with Brunei

Premier pledges closer ties with Brunei

Volkswagen's all-new GTI at New York auto show

Volkswagen's all-new GTI at New York auto show