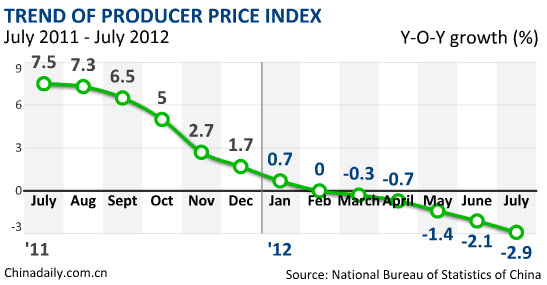

BEIJING -- China's Producer Price Index, a main gauge of inflation at the wholesale level, fell 2.9 percent in July from a year earlier, the National Bureau of Statistics said Thursday.

The data marked the fifth straight month of decline after China's PPI saw a drop in March for the first time since December 2009, NBS data showed.

On a month-on-month basis, the country's PPI for July moved down 0.8 percent, the NBS said in a statement on its website.

In July, producer purchase prices shed 3.4 percent year-on-year and 0.8 percent on a monthly basis, the NBS said.

In the first seven months of the year, the PPI went down one percent year-on-year, while producer purchase prices lost 0.8 percent, it said.

The NBS also announced Thursday that China's consumer price index, a key gauge of inflation, grew 1.8 percent year-on-year in July, the slowest pace since February 2010.

|

"The decline of the PPI has highlighted the grim facts of sluggish market demand, shrinking business orders and continuing destocking," he said.

Liu Yuhui, a researcher with the Chinese Academy of Social Sciences, said weak demand will be followed by narrower profits, which will in turn affect investment and employment.

"Policymakers should place more attention on downward pressure in the real economy," Qu said, adding that easing inflation will offer more room for policy fine-tuning.

In a report released last Sunday, the central bank said it will strengthen the fine-tuning of its monetary policy in the second half of the year and improve its credit policies to shore up the development of the real economy.

Producer purchase?prices in China

Rain-triggered farm produce price rise continues

System to price rare earths

China likely to raise fuel prices in Aug

Spot iron ore prices hit 8-month low

Steel prices face downward pressures

Land transfer prices increase

Imported iron ore prices flat on sluggish demand

Thermal-coal price in longest losing streak since 2008

China to adopt progressive water pricing

Washington to remain focused on Asia-Pacific

Washington to remain focused on Asia-Pacific RQFII target blue chips amid bear market

RQFII target blue chips amid bear market Australian recall for top two exporters

Australian recall for top two exporters China fears new car restrictions

China fears new car restrictions