Money

Investment value analysis of ChinaCache, ChinaNetCenter

(CBISMD)

Updated: 2010-09-26 16:45

|

Large Medium Small |

Internet content provider ChinaCache, with the spread of news about an IPO application in the United States and following a sharp drop in business in 2009, slightly improved revenue and continuing net loss numbers in the first half of 2010, the company reported.

Likewise, as one of the largest CDN service providers, ChinaNetCenter (stock code: 300017), which provides the same services as ChinaCache, has been questioned because of its declining performance after being listed on China's Growth Enterprises Market (GEM) board.

A comparison of the two formal public financial datasheets to explore the real investment value was contained in a full report from CBISMD. Those reports are included at the end of this report.

Net income findings

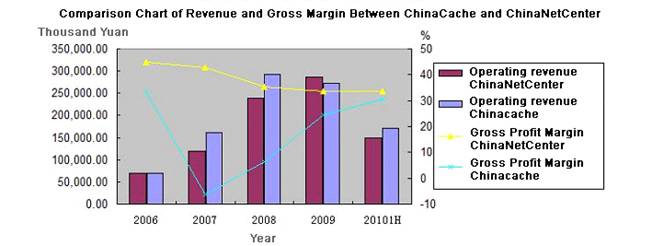

The two recently released financial datasheets showed that in the first half of 2010, ChinaCache had a net income 170.34 million yuan, and ChinaNetCenter had business income of 150.09 million yuan over the same period.

From the year 2006 to 2009, ChinaCache had a net income that increased from 70 million yuan to 272 million yuan, by nearly 3.9 times, but the gross profit growth did not follow. For ChinaNetCenter, from the year 2006 to 2009, business income increased from 69 million to 287 million yuan, by nearly 4.2 times, and the consolidated gross profit margin remained above 33 percent for four consecutive years.

Business growth

In the first half of 2010, the CDN business growth rate of ChinaCache was 28.86 percent, and 27.38 percent for ChinaNetCenter.

From the year 2007 to 2009, despite a slowdown in 2009, ChinaNetCenter's CDN business growth maintained a rapid rate of growth on the whole. The growth rate was 181.41 percent in 2007, 239.64 percent in 2008 and 58.78% in 2009.

ChinaCache's CDN business growth rate showed a decreasing trend. Its growth rate was 129.85 percent in 2007, 81.03 percent in 2008 and minus 6.53 percent (-6.53 percent) in 2009. The negative number in 2009 meant ChinaCache reached its lowest point.

In the first half of 2010, ChinaNetCenter's net profit attributable to shareholders of listed companies was 14.98 million yuan, while ChinaCache's net loss was 24.20 million yuan. Since 2005, five consecutive years of losses brought losses amounting to 151 million yuan for ChinaCache, which was even worse in 2008.

Over the years from 2006 to the first half of 2010, ChinaNetCenter net profit has maintained a constant growth rate. In 2008, its net profit amounted to 37 million yuan.

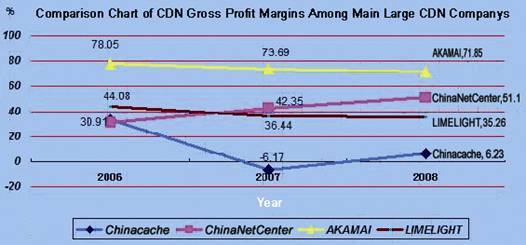

Profit margins

Over the years from 2006 to the first half of 2010, ChinaNetCenter's consolidated gross profit margins for four and a half consecutive years have always been above 30 percent. The consolidated gross profit margin was 44.76 percent in 2006, 42.93 percent in 2007, 35.50 percent in 2008, 33.80 percent in 2009 and 33.59 percent during the first half of 2010.

During the years 2005 and 2006, ChinaCache's gross profit margin averaged above 30 percent. The gross profit margin was 44.06 percent in 2005 and 33.20 percent in 2006. But the gross profit margin was minus 6.17 percent (-6.17%) in 2007. Since then, its gross margins have not ever reached the level of the previous two years, far below those of ChinaNetCenter.

By June 30, 2010, ChinaCache had 418 customers, among which China Mobile was the largest one. ChinaCache has always been the main CDN provider for Sina, Netease, Sohu, and Tencent, the Internet portals that have the greatest demand for CDN, and now only two portals -- Sohu and Tencent -- have contributed a small amount of income to ChinaCache.

ChinaNetCenter has 2,000 customers currently, among which Tencent is the largest. In addition, ChinaNetCenter is the main CDN provider for Tencent, Netease, Sohu and Sina, the four Chinese Internet portals.

ChinaNetCenter financial data from 2005 to 2010

Monetary unit: RMB Yuan

Items??????????????????? ?Year 2005????????????? Year 2006?????????????? ?Year 2007

Operating revenue????? ????? ? ?--??????????????????69,009,500???????????? ?119,323,092

Net profit attributable

to shareholders of

listed companies????????? ????? ??--??????????????????16,241,200????????????? 25,481,168

Consolidated gross

profit margin???????????? ????????? ?--??????????????????44.76%????????????????? ??42.93%

Growth rate of CDN

business (year-on-year)????? ?--?????????????????? --???????????????????????? ?181.41%

Items?????????????????????????? Year 2008??????????????? Year 2009???????????First half of 2010

Operating revenue???????? ?239,031,077???????????? 287,013,386????????????150,093,015

Net profit attributable

to shareholders of

listed companies??????????? ?37,078,501????????????? 38,851,373?????????????? 14,983,248

Consolidated gross

profit margin????????????????? ?35.50%?????????????????? ? 33.80%???????????????? ? 33.59%

Growth rate of CDN

business (year-on-year)?? ?239.64%????????????????? 58.78%?????????????????? 27.38%

ChinaCache financial data from 2005 to 2010

Monetary unit: RMB Yuan

Items???????????????????????? ?Year 2005???????????? ?Year 2006?????????? ? Year 2007

Net revenues???????????? ?? 47,025,000????????????? 70,033,000??????????? 160,973,000

Net loss?????????????????? ???? 5,278,000???????????????29,790,000????????????87,913,000

Net loss attributable

to ordinary shareholders??? 7,378,000?????????????36,397,000??????????? 99,215,000

Consolidated gross

profit margin????????????? ???? 44.06%?????????????????? 33.20%????????????????-6.17%

Growth rate of CDN

business (year-on-year)???? ?--???????????????????? ?48.93%??????????????? 129.85%

Items???????????????????????????? Year 2008??????????????? Year 2009?????????? First half of 2010

Net revenues?????????????????? 291,404,000??????????????272,370,000??????????????170,342,000

Net loss????????????????????? ?151,800,000??????????????? ?39,167,000??????????????24,201,000

Net loss attributable

to ordinary shareholders?????162,981,000???????????75,244,000??????????????52,026,000

Consolidated gross

profit margin????????????????? ??6.23%????????????????????? ?24.30%??????????????????30.45%

Growth rate of CDN

business (year-on-year)?????????81.03%???????????????? -6.53%??????????????????28.86%?

(Data Source: Application Document F-1 for IPO in the US ChinaCache reported to the Securities and Exchange Commission (SEC) and ChinaNetCenter Public Financial Report)