Specials

Yuan revaluation talk heats up

(chinadaily.com.cn)

Updated: 2010-03-23 10:25

|

Large Medium Small |

Editor's note: The debate on the valuation of the yuan has been escalating.

Editor's note: The debate on the valuation of the yuan has been escalating.

Chinese Premier Wen Jiabao said at the end of the annual meeting of the top legislature on March 14 that the Chinese currency is not undervalued as the United States stepped up pressure for China to change its currency policy.

What's behind the US push? How will China respond? And?in what direction will the value of the yuan, or renminbi, move in the future??

|

|

|

Latest Development |

Sino-US tensions show no sign of easing

There are no clear signals of an easing in trade and political tensions in Sino-US relations despite the hope generated by the visits of two Chinese vice-ministers to Washington. [Full Story]

Geithner: US cannot force China over RMB

US Treasury Secretary Timothy Geithner said on Wednesday, March 24?that the United States cannot force China to change its exchange rate. [Full Story]

Wen upbeat on US relations despite strains

Premier Wen Jiabao on Monday, March 22?rejected US accusations that the country undervalues its currency to seek a trade surplus.

Premier on Sino-US ties: Seeks to ease economic strains with Washington; Offers May strategic and economic dialogue in Beijing as forum to resolve differences; Warns against "currency or trade war"; Pledges to increase imports from US. [Full Story]

|

Tit-for-tat between?China and US |

March 21: Minister warns China will fight back if declared currency manipulator

March 19: He Ning calls on Washington to cool yuan pressure

March 16: Yao Jian denies yuan behind US trade gap

March 16: 5 US?senators introduce Schumer bill on yuan

March 15: 130 US lawmakers demand Obama get tough with China over yuan

March 14: Wen stands firm on yuan, says stable rate has helped global recovery

March 12: Don't politicize yuan, Su Ning tells Obama

March 11: Obama criticizes Chinese currency policies

|

US strategy behind?yuan rise talks |

|

A. To ease trade deficit with China In the United States, talks?are escalating about?the huge trade?deficit?with China, which many believe has cost millions of US manufacturing jobs. Many Americans believe?a rise in yuan?could?help because?it could make China's exports more expensive and less competitive in the US market.? |

|

B.?To reduce value of US debt held by China

A stronger yuan could significantly lower the value of China's dollar assets and drag down China's economy. Thus, the US has dramatically stepped up pressure on China. China is the biggest overseas owner of US treasury bonds, with staggering holdings of?$889 billion, according to data released on?March 15?in Washington by the United States Treasury Department. |

|

C.?To sustain dollar's dominance The dollar's dominant role as global reserve currency will be under threat if China makes its currency fully convertible. It is an?inevitable choice for the US to force?the yuan to appreciate in order to maintain the dollar's dominance and contain the emergence of the yuan as an international currency.? |

Similar?case: Plaza Accord in 1985

Yen and the art of currency maintenance

In the 1980s, when the US ran a huge trade deficit with Japan, Washington forced the Asian power to drastically revalue the yen, as agreed upon?in the Plaza Accord. But the US trade balance did not improve, and there was a massive stock market and real estate bubble in Japan.

The Plaza Accord was an agreement signed by the governments of France, West Germany, Japan, the United States, and the Britain on September 22, 1985 at the Plaza Hotel in New York City, to depreciate the US dollar in relation to the Japanese yen and German Deutsche Mark by intervening in currency markets. The exchange rate value of the dollar versus the yen declined by 51 percent from 1985 to 1987. [Full Story]

|

Debate |

|

Pros Chinese yuan is grossly undervalued, consequently its cheap goods bring about trade surplus against US and harm the American economy. Yuan's appreciation can resolve imbalances in the world economy. |

Cons It's only a myth that Chinese yuan causes American economic problems. A stronger yuan cannot inspire US export, and a sharp revaluation of yuan would be a lose-lose situation for two countries.? |

|

Western opinions |

|

UN body against change in yuan

|

EU: Wrong to pressure China on RMB

|

|

World Bank: More flexibility may help

|

Obama is 'playing with fire' over yuan

|

Influence of a rise in yuan

Chinese labor-intensive exporters will bear the brunt

A?Chinese semi-official trade group said a stronger yuan will spell the end for many Chinese exporters in labor-intensive sectors such as garments and furniture.

A?Chinese semi-official trade group said a stronger yuan will spell the end for many Chinese exporters in labor-intensive sectors such as garments and furniture.

"If the yuan rises, these companies will face the immediate risk of going bust as their profit margin is already very narrow," said Zhang Wei, vice-chairman of the China Council for the Promotion of International Trade.

"So for these companies, the consequences would be disastrous," he told a news conference.?[Full Story]

Sharp revaluation of yuan would be 'lose-lose' situation

The debate over China's currency policy is heating up among economists with Morgan Stanley Asia Chairman Stephen Roach saying that a sharp upward revaluation of the yuan would lead to a disastrous outcome for the United States and it would end up as a "lose-lose situation" for both Washington and Beijing.

"This is a disastrous outcome for the United States and would certainly be a very bad outcome for Chinese exporters as well," he said.[Full Story]

A stronger yuan may hurt US exporters, consumers

A stronger Chinese yuan will eventually hurt US exporters and cost US consumers more, said two US foreign exchange experts in an article published Tuesday by the US Foreign Policy journal. [Full Story]

A stronger Chinese yuan will eventually hurt US exporters and cost US consumers more, said two US foreign exchange experts in an article published Tuesday by the US Foreign Policy journal. [Full Story]

Paper stocks may gain on yuan revaluation talk

Equities in China's paper manufacturing industry are poised to gain in the near term amid market expectations of a stronger yuan triggered by the steady recovery of exports, analysts said. [Full Story]

|

Three ways?to revalue yuan |

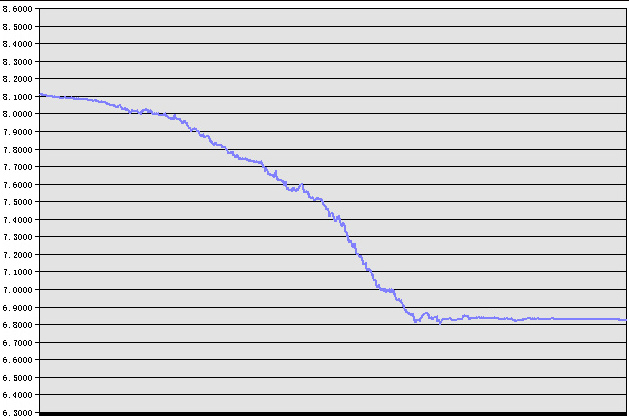

Value of the yuan VS the US dollar between July 21, 2005 and March 22, 2010. [Photo/People's Bank of China]

Value of the yuan VS the US dollar between July 21, 2005 and March 22, 2010. [Photo/People's Bank of China]

Radical way: Dramatic rise

In this way, the yuan may rise dramatically once and for all, so as to dispel strong expectation of appreciation in the Chinese currency. This means the value of the yuan would?rise?by about 20 percent against the US dollar at one time and remain unchanged for the next three to five years.

Supporters say this is an effective way to dismiss appreciation expectations, which the government hopes to avoid if it revalues its currency. However, this method is opposed by many experts.

Conservative way: Gradual rise at slow pace

In this way, China would resume a floating exchange regime that was employed?between July 2005 and July 2008 and allow the yuan to rise gradually at a slow pace. However, it would draw in international speculative capital, which would greatly inflate liquidity and drive up asset prices.?

Workable plan: Gradual readjustment

Sources close to the central bank believe that this is the?viable way, which may include a one-off revaluation at the preliminary stage and a gradual readjustment later on. This is supported by a number of renowned economists, such as Dr Ha Jiming, chief economist at China International Capital Corp.

| 分享按鈕 |

The global economic crisis, a huge US budget deficit and a high jobless rate have made Americans increasingly concerned about China's huge holdings of?US treasury bonds.?The concerns are about a reduction in the debt as well as an increase, because a steep reduction will?harm the US economy while a rise will make the US more financially dependent on the fastest-growing economy.?

The global economic crisis, a huge US budget deficit and a high jobless rate have made Americans increasingly concerned about China's huge holdings of?US treasury bonds.?The concerns are about a reduction in the debt as well as an increase, because a steep reduction will?harm the US economy while a rise will make the US more financially dependent on the fastest-growing economy.?

Leaving currencies to irrational market forces "will not help rebalance the global economy," said a UN agency.[

Leaving currencies to irrational market forces "will not help rebalance the global economy," said a UN agency.[ EU Ambassador to China Serge Abou said that the exchange rate was a "very complex issue" and pressure should not be put on China's currency.?[

EU Ambassador to China Serge Abou said that the exchange rate was a "very complex issue" and pressure should not be put on China's currency.?[ The World Bank said more exchange rate flexibility would help if Chinese leaders worry that higher interest rates might draw in speculative capital. [

The World Bank said more exchange rate flexibility would help if Chinese leaders worry that higher interest rates might draw in speculative capital. [ US President Barack Obama's pressure on China over its currency's exchange rate is a manifestation of hypocrisy from the West and will not work, a British economist has said. [

US President Barack Obama's pressure on China over its currency's exchange rate is a manifestation of hypocrisy from the West and will not work, a British economist has said. [