Biz News Flash

Railroad operator to float shares

By Li Xiang and Mao Lijun (China Daily)

Updated: 2010-03-02 09:20

|

Large Medium Small |

|

|

|

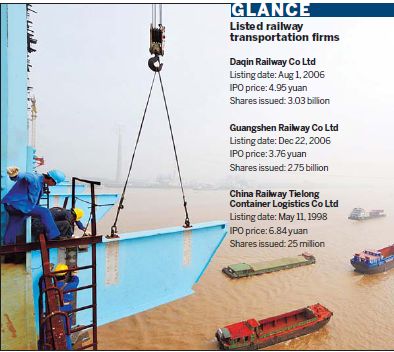

Construction workers building the Nanjing Dashengguan Yangtze River Bridge, part of the Beijing-Shanghai High-Speed Railway project. [China Daily] |

The ministry is preparing the IPO proposal and has submitted it to key government departments including the Ministry of Finance, the National Development and Reform Commission and the State-owned Assets Supervision and Administration Commission for further review, the source said.

The IPO plan has to be approved by the State Council as the project is still under construction and the company does not have the regulatory requirement of a three-year profit record, said the source on condition of anonymity.

China Railway Investment Corp (CRIC), owned by the Ministry of Railways, is the largest shareholder of the Beijing-Shanghai High-Speed Railway Co Ltd, set up in 2007. CRIC holds a 56.2 percent stake in the project and said it intends to shed 4.5 percent stake to raise about 6 billion yuan for more construction projects.

Ping An Asset Management Ltd and the National Council for the Social Security Fund are the second and third largest shareholders of the project, owning 13.9 percent and 8.7 percent of the stake.

Railway projects in the country are largely financed through national funds and railway construction bonds issued by the Ministry of Railways. But the ministry is now exploring alternate channels to raise capital.

Lin Sheng, an analyst at Essence Securities, said the IPO would ease the fund raising pressure for the project and any impact on the general market would be largely neutral.

Work on the 1,318-km high-speed railway project started in April 2008 with a planned investment of 220.9 billion yuan. It is expected to be operational by 2012. So far, nearly 122.4 billion yuan has been invested on the project.

"The railway industry has strong and sustainable growth potential and we expect it to experience a high growth period over the next three years," Lin said.

"The government is unlikely to withdraw the stimulus policies for the sector as railway construction is a crucial economic engine that would fuel growth in other related industries like machinery, building materials and telecommunication," he said.

Lin said that railway shares are good defensive options that offer guaranteed returns for investors.

China is aggressively expanding its railway network with over 2.1 trillion yuan worth of construction projects currently under way. By the end of 2012, the country's high-speed railway is expected to account for half of the world's total length.

Shares of domestic railway firms rose sharply last year, after US investment guru Warren Buffett bought a 77 percent stake in Burlington Northern Santa Fe Railway, indicating that golden days are ahead for shareholders.