Top Biz News

Copper down on tightening fears

(China Daily/Agencies)

Updated: 2010-01-21 07:56

|

Large Medium Small |

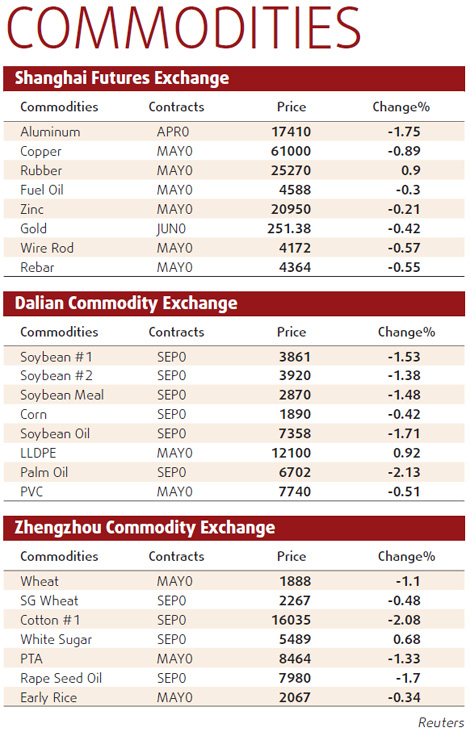

Shanghai copper fell 1 percent yesterday, after China's central bank signaled another move to tighten monetary policy and the dollar gained, but sentiment was still supported by strong demand outlook.

The US dollar hit a five-month high against the euro on continued concern about Greece's fiscal problems and after breaking below a key chart level that could signal a bearish trend for the currency.

Banking authorities have instructed some major banks to halt their lending during the rest of January after a burst of credit in the first couple of weeks, media and banking sources said.

Just on Tuesday, the central bank lifted the auction yield on one-year bills in its regular open market operations, a second week in a row.

"The series of tightening moves surely has an impact on the market, but the accumulated force has not been strong enough to knock out metals prices," said Zhu Yanzhong, an analyst at Jinrui Futures.

Zhu said the upward trend was intact in general, unless the central bank made more pronounced moves, such as rate hikes, any time soon.

Shanghai's benchmark third-month copper futures contract ended down 1 percent at 61,000 yuan ($8,934.72) a ton, after touching 62,000 yuan in early trade, highest in a week and half.

The most-active contract for May delivery fell 1.3 percent to 61,000 yuan a ton.

Three-month copper on the London Metal Exchange pared early gains to lose $26.25 to $7,518.75 a ton in early trade.

"Prices are likely to move sideways in an upward channel this week, but it would be difficult to reach previous highs."

The government is scheduled to release key economic data today, expected to show the economy probably gathered strength in December, while consumer price index may have risen at the fastest pace since February 2008.

But some investors and analysts said the liquidity in the market was unlikely to shrink any time soon.

Among other LME metals, aluminum declined 0.5 percent to $2,281 a ton, nickel fell 1.5 percent to $18,925 a ton, and tin dropped 0.4 percent to $17,900 a ton. Zinc lost 0.6 percent to $2,489 a ton, and lead shed 0.2 percent to $2,421 a ton.