|

BIZCHINA> Insights

|

|

Watching for signs of a tighter new fiscal policy

By Ou Lu (China Daily)

Updated: 2009-11-02 08:44  Remaining proactive "China's 4 trillion yuan stimulus package is a three-year plan, and it is expected to spend another 500 billion yuan in some investment projects in 2010. Therefore, the country will stick to proactive fiscal policy in the coming year," Ba Shusong, a deputy director with the Development Research Center of the State Council, said last week at an international economic forum in Geneva. Investment in the first half of the year was largely government-led, but now the sources of growth are more diverse, said Wang Qing from Morgan Stanley. Capital spending by mostly private real estate developers is now surging in response to the ready availability of credit and growing confidence in the economy, he said, adding that the investment will come from more sources in 2010. Investment growth Lian Ping, chief economist at the Bank of Communications, said that investment is expected to grow by more than 30 percent in 2010, spurred by more central government-funded projects and higher business confidence levels.

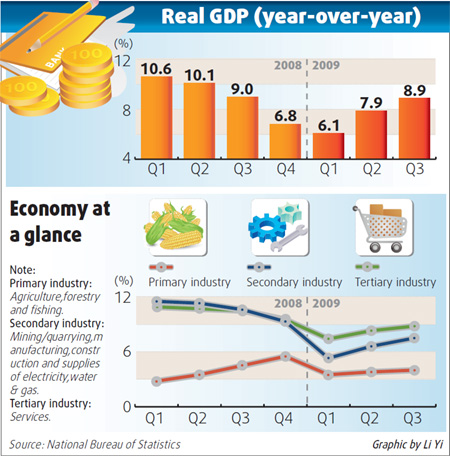

New central government-funded projects, more confidence in the economic recovery and active housing and auto markets will contribute to a huge demand for new loans, he said. Wang said he believes the government might limit new lending to a normal level, say 7 trillion yuan to 8 trillion yuan for all of 2010, since it is now anticipated that the current ultra-loose monetary policy will allow full-year lending in 2009 to reach 10 trillion yuan. Some still argue that China's investment was lopsided, going largely to old-fashioned infrastructure projects. Critics said little of it was used to boost domestic consumption, a new growth engine following the collapse of China's export sector in late 2008. Over the first nine months, the economy grew 7.7 percent. Of that, investment accounted for 7.3 percentage points and consumption 4 percentage points. (For more biz stories, please visit Industries)

|

|||||||