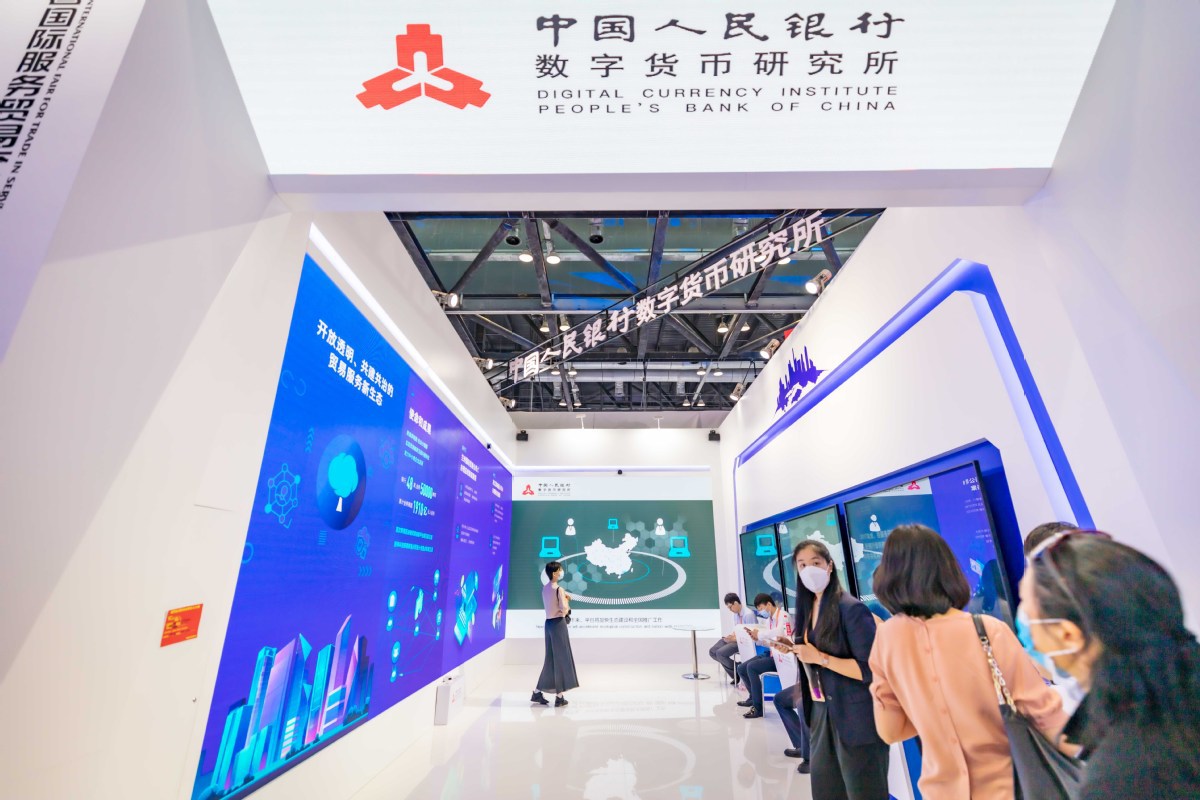

Central bank to expand trials of digital RMB

Analysts predict that China's e-currency could be in circulation as early as 2022

China's monetary authorities will designate more payment service institutions to develop digital RMB electronic wallets with complicated functions, in order to satisfy various types of payment needs, said a senior official from the central bank.

For example, the digital RMB e-wallet with smart contracts, also known as a "smart wallet", has a powerful feature that allows users to implement payment autonomously under certain conditions and rules, which can prevent the illegal withdrawal of funds deposited in prepaid accounts, according to Mu Changchun, director general of the Digital Currency Research Institute of the People's Bank of China.

It was the first time that the nation's leading designer of digital RMB, or e-CNY, disclosed various functions of the e-wallet, and he called it the currency's "carrier". The digital RMB is expected to be one of the world's first major sovereign digital currencies, and the central bank is gradually expanding its trials.

The digital RMB e-wallet is managed under a centralized system led by the central bank, which can verify the currency's authenticity. It is designed with multilevel permissions for transferring funds.

At the lowest level, users can deposit as much as 10,000 yuan ($1,562) of digital RMB in the wallet, and the maximum aggregate daily payment is 5,000 yuan, with a limit of 2,000 yuan for each transaction. Users can open an account after providing their cellphone number, Mu told the Lujiazui Forum in Shanghai on Friday.

For a higher level e-wallet, the maximum deposit will increase to 500,000 yuan, with limits of 50,000 yuan for each payment and 100,000 yuan for the daily aggregate payment, according to Mu.

On the same day, 350,000 residents of Shanghai each received a lucky draw bonus of 200 yuan in digital RMB, which was sent by designated commercial banks and payment service providers through various electronic wallet apps on smartphones. About 2 million users had applied for the bonus in Shanghai's trial.

Some experts predicted that the digital RMB could become the first central bank digital currency in circulation as early as 2022, ahead of other major economies, and cross-border usage may continue to grow.

Stephen Chiu, Asia FX and rates strategist of Bloomberg Intelligence, predicted that the digital RMB's envisaged applications will be in tourism, payments, clearing and even central-bank swap lines.

Chinese financial regulators see the digital RMB as one way to fend off potential threats from privately designed virtual currencies, such as Bitcoin, experts said.

Earlier, two online private commercial banks-WeBank, backed by Tencent Holdings Ltd, and Zhejiang E-Commerce Bank Co Ltd (MY-bank), supported by Alibaba's Ant Group Co, were identified by the central bank as operational institutions of the digital RMB, providing currency exchange and circulation services.

Ant Group's Alipay and Tencent's WeChat Pay, the two dominant electronic payment platforms in China, can also offer the functions of an e-wallet, Mu said.

China's six largest State-owned commercial banks have all opened digital wallets, which have also added applications to pay digital RMB to e-commerce platforms such as food delivery service Ele.me.

The expansion of the digital RMB's payment system will help connect different internet platforms, and the central-bank-backed e-CNY system is not in a competitive relationship with major third-party payment service providers, said analysts.

Mu reiterated that the digital RMB will coexist with Alipay and WeChat Pay. And the e-wallets are designed to satisfy different demands. Individuals and companies will be able to open customized e-wallets, he said.

There will be many formats for e-wallets, according to Mu, including IC cards, wearable devices and internet of things devices. The central bank has launched a so-called hard wallet product loaded with a health code function for elderly people, which not only provides convenient payment functions, but also facilitates their safe travel while the pandemic continues, Mu said.