BOAO, Hainan -- The 5G industry created massive direct economic output in 2020, according to a new white paper.

Last year, 5G directly led to 810.9 billion yuan ($125 billion) in gross economic output, according to a white paper on 5G development and its economic and social impact. The China Academy of Information and Communication Technology released the white paper.

The industry directly generated 189.7 billion yuan of economic value added and indirectly brought about 2.1 trillion yuan in gross output in 2020, the white paper said. 5G also indirectly led to about 760.6 billion yuan of EVA last year.

"Of the more than 800 billion yuan, half was generated by mobile phone terminals, while about 200 billion yuan was an investment for the Internet construction," Yang Jie, chairman of Chinese telecom company China Mobile, said at a sub-forum of the Boao Forum for Asia annual conference. "Meanwhile, 5G information services contributed less than 200 billion yuan."

Many industries have been actively promoting the application of 5G, including the medical industry and manufacturing, said Hu Houkun, deputy chairman of Chinese tech giant Huawei.

Premier Li Keqiang has highlighted the need to balance the growth of the economy, residential income and the job market, saying China will not pursue the growth of its GDP at the cost of high energy consumption and high pollution.

In a video conference with foreign representatives to the China Development Forum 2021 in Beijing on Monday, Li said China will give priority to growth with higher quality and efficiency while maintaining the stable fundamentals of is economy.

In doing so, the country must attain relatively full employment, the sustained growth of residential income, a continuously improving ecology and environment, the further refining of its economic structure and steady improvement in labor productivity, he said.

Li also explained the government's decision to set the target of this year's economic growth at above 6 percent, saying the goal took into account the ongoing economic recovery and the need to consolidate the foundation of growth.

The target will also be better aligned with goals to be set next year and the year after next, he added.

While a growth target of at least 6 percent is not low, the actual economic growth this year could be higher, he said, adding the government is trying to better guide market expectations.

The premier also stressed the need to improve the vitality and performance of market entities, keep moving forward with the urbanization process, unleash the immense potential of consumer spending and harness the role of consumption in spurring economic growth.

Ensuring the continuing security of China's energy needs remains Saudi Aramco's highest priority, not just for the next five years but the next 50 and beyond, said Aramco CEO Amin Nasser during the China Development Forum held in Beijing on Sunday.

"We see opportunities for further investments in integrated downstream projects to help meet China's needs for heavy transport and chemicals, as well as lubricants and non-metallic materials," Nasser said.

Being a top supplier of China's energy needs, Aramco is well-placed to help China achieve its second centenary goal, he said, adding the company also appreciates that sustainable energy solutions are crucial to a faster and smoother global energy transition, as are realistic roadmaps and practical priorities.

Nasser said he looks forward to contributing even more to China's economic development and common prosperity and aims to be side-by-side with Chinese partners, delivering these strategic, value-adding, parallel priorities.

One of the company's priorities is developing new energy infrastructure, and fixing the technical and economic challenges new sources of energy face.

New and existing energy sources will need to run in parallel for quite some time to come as this will take some time since there are few alternatives to oil in many areas, he said.

Aramco already has a research center in Beijing, where it is working with Chinese universities and companies to develop cleaner engine-fuel systems, catalytic crude-to-chemicals technology and studies to reduce emissions.

It plans to intensify research collaboration, highlighting blue hydrogen and ammonia, low-carbon products, synthetic fuels and carbon capture, utilization and storage as essential to achieving Aramco's long-term, low-carbon ambitions.

China's continued opening-up measures will accelerate high-quality development during the next five years and create several development opportunities for global investors, officials and experts said.

He Lifeng, head of the National Development and Reform Commission, said China will continue to pursue high-standard opening-up at various levels during the 14th Five-Year Plan period (2021-25), with a key focus on opening up more sectors in a more thorough fashion and boosting international economic cooperation.

"China will not shut its door to opening-up. Instead, it will embrace the world with more open arms," He said on Sunday at the China Development Forum 2021 in Beijing. "We have to facilitate trade and investment, further promote steady development of imports and exports, shorten the negative list for foreign investment access, improve post-establishment national treatment …"

More efforts will also be made to pursue high-quality development via the Belt and Road Initiative, improve infrastructure connectivity and e-commerce along the Belt and Road, deepen international industrial capacity cooperation, maintain multilateral economic governance framework, work toward signing more high-quality free trade deals and build a community of shared future for humanity, said He.

Speaking about the new dual-circulation development pattern in the 14th Five-Year Plan, Qian Keming, vice-minister of commerce, said: "What we envision is not a development loop behind closed doors, but a more open domestic and international circulation.

"With domestic residents' improved standard of living and the acceleration of industrial upgrading, China has witnessed a growing demand for high-end consumer goods, intermediate goods, capital goods and services. However, due to the insufficient high-quality domestic supply, we need to expand opening-up and increase imports to balance the gap between demand and supply. To foster smooth domestic circulation, we may need to import more than $2 trillion worth of goods and nearly $500 billion worth of services each year."

As a next step, Qian said, the Ministry of Commerce will ramp up efforts to advance opening-up on a larger scale and at a deeper level, including lowering the market access threshold for foreign investment, expanding institutional opening-up, improving the business environment and deepening international cooperation.

Under the new development pattern, high-level opening-up measures will promote better connections between China and the rest of the world and enable China to share more opportunities for common development with other countries, Qian said.

Xu Hongcai, deputy director of the China Association of Policy Science's economic policy committee, said China had ramped up efforts to advance opening-up last year, despite COVID-19, and has already made a good start this year.

"To deepen reforms and expand opening-up at higher levels, China needs to pursue institutional opening-up measures instead of simply boosting liberalization and facilitation of trade investment, including improving its system for foreign investment management based on pre-establishment national treatment and negative list and encouraging fair market competition," Xu said.

Zhang Yansheng, chief researcher at the China Center for International Economic Exchanges, said the country's new development paradigm emphasizes building an open economy and bolstering ties with other nations, demonstrating the firm determination to deeply integrate itself into the wider global economy.

William Zhao, country chair of Total China, the local unit of the French oil and gas giant, said he remains optimistic on the huge growth potential of the Chinese market.

"China was the first country to come out of the pandemic. Its economy bounced back last year and will grow very strongly this year," Zhao said.

"China has been reducing the negative list and opening up the economy to foreign investors for years. That's a great step forward. I think the next step is about really attracting FDI as well as technology investment to develop the next stage in the energy sector … For Total, I think it's very important to be here and invest in this environment."

The nation's accelerating opening-up with institutional guarantees, including rules and norms will enable more global companies to expand their presence in areas like high-tech manufacturing, new energy and retail in the coming years, said foreign business leaders at the 2021 China Development Forum over the weekend.

With more industries and areas being opened to foreign investment, Mark Schneider, CEO of Nestle, the Swiss food and beverage giant, said overseas companies investing in China now have more opportunities than ever in terms of preferential policies, such as exemption from or reduction of tariffs and taxes.

"We have seen improvement in the business environment for foreign companies. All levels of government are showing determination to support the companies. Our investment experience in Heilongjiang province certainly underlines this," he said.

Apart from promoting the integration of international and domestic industrial chains, the Ministry of Commerce introduced 22 measures in early March to further expand high-level opening-up and attract more resources, including technologies and talents from global markets, to reinforce China's strengths in attracting foreign direct investment.

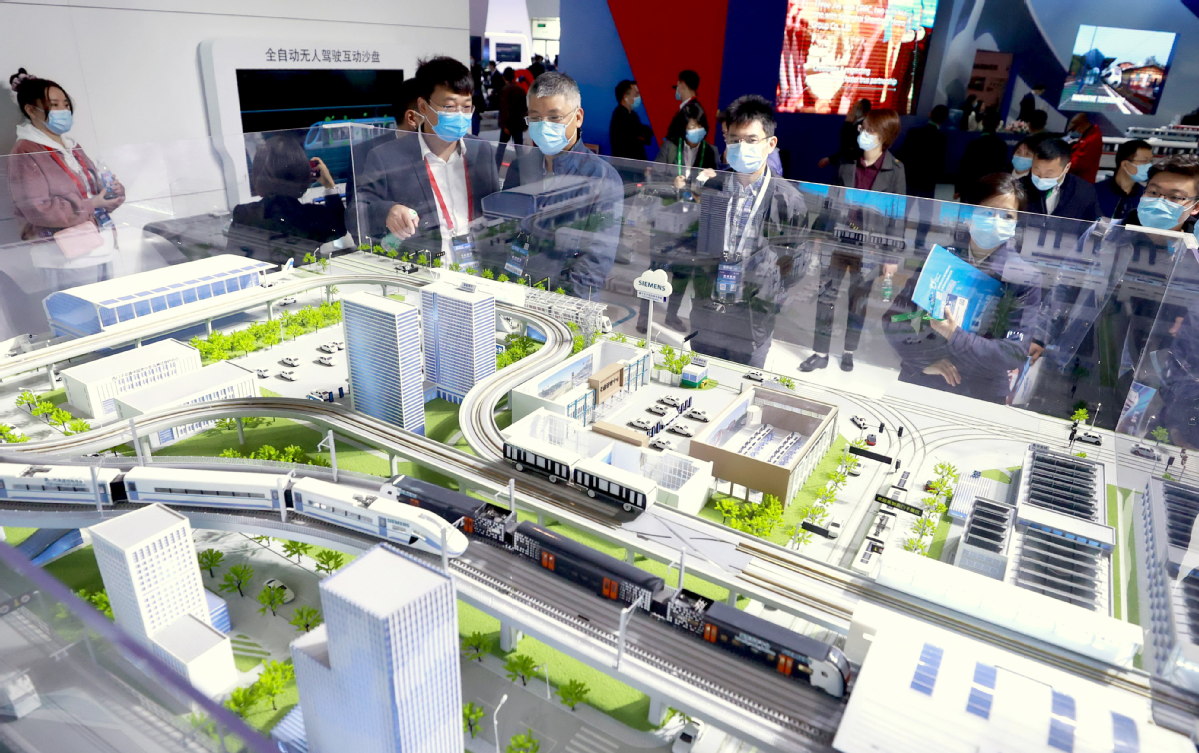

Siemens AG, the German technology company, plans to deploy more resources to increase market share in China's infrastructure, healthcare, urban and interurban transport systems during the country's 14th Five-Year Plan period (2021-25), said Roland Busch, president and CEO of Siemens AG.

By putting innovation and progress front and center, China's 14th Five-Year Plan will take economic and social development to the next level, he said.

"This plan stands for a conviction that Siemens shares and that drives us," Busch said, adding that with the ambitious expansion of future industries and markets, new technologies are brought into the mainstream.

Because many companies across various sectors have already started their digital transformation, especially in China, he said in Siemens' new digital factory in Nanjing, Jiangsu province, which will be put into operation later this year, its productivity would increase 20 percent by deploying Industry 4.0 digital technologies along the entire value chain.

Despite COVID-19, China's actual use of foreign direct investment surged 31.5 percent on a yearly basis to 176.76 billion yuan ($26.07 billion) in the first two months of this year, the Ministry of Commerce said.

Volkmar Denner, chairman of the board of management at Robert Bosch GmbH, said China's policies to speed up the growth of green finance and a low-carbon economy will increase energy efficiency, expand the supply of green energy, and procure more green power in its next development stage.

Climate change calls for action not only in the mobility sector, but in all industries. In consumer goods, products are becoming increasingly energy-efficient, especially heaters and home appliances. In manufacturing, lines are being upgraded so that they are smarter and more energy-efficient, he said.

The German company invested $594.4 million in electro-mobility, including new energy vehicle powertrains and fuel cells in China last year. It has set up a fuel cell technical center in Wuxi, Jiangsu province, and also achieved volume production of 48-volt-batteries in Wuxi and eAxles, a compact, cost-attractive electric drive solution for battery-powered electric vehicles and hybrid applications, in Taicang in the same province, as they are key technologies for hybrid and electric vehicles.

Florent Menegaux, CEO of Michelin Group, said China's move to further cut carbon emissions will push more multinational corporations to accelerate the pace to adopt more digital solutions and green electricity in China.

"All science-based evidence indicates that radical actions must be taken to ensure a sustainable future," Menegaux said. "The need for a green transformation is no longer a matter of debate. It is a necessity," he said, adding that the company has made big-ticket investments in China, including at its Shenyang factory in Liaoning province.

PBOC to add climate change factors as part of monetary policy framework

The People's Bank of China, the central bank, has decided to adjust its monetary policy framework by including climate change-related factors, an indication that policymakers are focusing more on sustainability and financial stability as the economy continues to recover from COVID-19 shocks, experts said on Monday.

Green finance could prove very useful in combating the ill-effects of climate change that may heighten credit, market and liquidity risks, and further undermine the stability of the entire financial system, they said after the PBOC governor announced more steps for achieving the target.

"We will incorporate climate change into the policy framework," PBOC Governor Yi Gang said during a roundtable discussion at the China Development Forum 2021 in Beijing on Saturday.

The PBOC is looking at the possibility of including climate change factors in the stress test of financial institutions, Yi said. "We are also exploring the role of monetary policy in encouraging financial institutions to support carbon emission reduction."

In terms of monetary policy, the central bank will encourage financial institutions to extend credit support for controlling carbon emissions through adoption of preferential interest rates and special re-lending facility of green finance, the governor said.

Yi said monetary authorities will further increase the share of green bonds, limit investment in carbon-intensive assets and incorporate climate risk factors into the risk management framework of the country's $3.2 trillion foreign exchange reserves, the world's largest.

Dong Shanning, director of green finance, Bank of Jiangsu, said the PBOC's actions have encouraged commercial banks to develop green finance. Since January this year, "green finance" was included in the annual assessment of commercial banks' performance, and green bonds with ratings of "AA" and above have been accepted as qualified collaterals for the central bank's various lending facilities.

Through these monetary policy tools, commercial banks can receive funds at favorable interest rates, meaning cheaper funding costs. Some provincial or municipal governments also provide subsidies to green bond issuers to cover part of, or the entire, interest rate payments, Dong said while speaking at the Global Association of Risk Professionals 2021 Risk Convention last month.

Zhao Penggao, deputy director of the environmental resources department of the National Development and Reform Commission, told a seminar last week about China's pronounced goal of peaking carbon emissions by 2030 and achieving carbon neutrality by 2060, or the"30/60 goal".

Experts at the seminar suggested speeding up the introduction of top-level design of policies, or a"1+N" policy system, with setting specific goals at each stage and clarifying basic principles.

PBOC Governor Yi highlighted need to strengthen information disclosure relative to climate change issues, in order to strengthen green finance. In China, the use of funds raised from green financial bonds in the interbank market is now required to be disclosed on a quarterly basis. Financial institutions are also required to report the use and allocation of green loans.

"Going forward, the PBOC plans to develop a mandatory disclosure system that would require all financial institutions and firms to follow uniform disclosure standards," he said.

China is about to finish revising a catalog of green bond-endorsed projects, and the new version will remove fossil fuel projects. China's central bank is now working with its European counterparts to harmonize taxonomies and plans to announce a common taxonomy this year, an issue that will also be discussed at the G20 meetings, according to the PBOC.

Easier access for foreign investors to China's green finance market will support the country's efforts to achieve net-zero emissions by 2060, said Ron O'Hanley, chairman and CEO of State Street Corp, a US-based financial services company.

"We also welcome China's steps to further open up the bond market and provide foreign investors with access to a wider range of financial products. Harmonizing domestic and global green standards will catalyze further investments in China's green finance market," he said.

The country's long-term goal to achieve carbon neutrality has been mirrored in the A-share market performance, with stock prices of carbon neutrality-related companies rising by an average 4.07 percent on Monday, while the benchmark Shanghai Composite Index gained 1.14 percent to close at 3443.44 points.

Prices of carbon neutrality-related Shenzhen Energy Corp, Jilin Electric Power Co Ltd and Beijing Jingyuntong Technology Co Ltd increased by the daily limit of 10 percent. Steelmaker Beijing Shougang Co Ltd, which was recently surveyed by the country's social security fund, a long-term value investor, also saw its price hit the daily ceiling of 10 percent.

Analysts from Industrial Securities said in a report that carbon neutrality will lead to an upgraded version of supply-side reform in China. While the country's goal to cut greenhouse gas emissions indicates opportunities for environmental protection industry, small and medium-sized enterprises in the energy-intensive industries will be forced out of the market due to stricter environmental protection regulations.

In other words, manufacturers such as steel or coal enterprises will see their costs further escalate. Industry leaders, especially those in the mid to upstream of the value chain, will be preferred by investors thanks to their stronger capability to control energy consumption, according to Industrial Securities analysts.

Hydrogen-fueled cars may see more development in China given their high efficiency and low emissions. Domestic carmakers and component manufacturers have rich technology development and operational experience in this aspect, which points to opportunities for investors, said Ping An Securities analysts.

Experts from CITIC Securities are of the view that investors should look for opportunities in sectors where local governments can come up with specific development plans. Wind power, for example, may see detailed development plans from Beijing and follow-up guidelines in different provinces and cities. Investors can look for opportunities in this area. Meanwhile, green logistics, natural gas and new energy vehicles may also be good investment targets, they said.

During the three-day China Development Forum that started in Beijing on Saturday, Zhang Lei, CEO of private equity firm Hillhouse Capital, said China may need hundreds of trillions of yuan as investment to achieve its carbon neutrality goal, a large part of which will be contributed by private equity and venture capital firms. According to the technology roadmap of carbon neutrality, Hillhouse Capital has already invested throughout the industrial chains of photovoltaic, new energy vehicles and chip industries, he said.

The 2021 China Development Forum kicked off on Saturday online and on-site in Beijing, gathering officials, executives and scholars in business, science and other circles to discuss topics around the 14th Five-Year Plan, China-US relations, global public health, technological innovation, green transformation and more.

The three-day event with the theme of "China on a New Journey of Modernization" has attracted more than 130 overseas delegates from high-ranking officials to top executives of international corporations.

Let's take a look at what they've said.

Han Zheng, vice-premier of China

Han said, the new development paradigm China is building will not involve closed-door circulation, but rather a more outward-looking one with a mix of domestic and international circulation. China welcomes companies from all around the world to share its market potential and its opening-up will expand wider.

Henry Kissinger, former US secretary of state

"Fundamentally, China and the United States are two great societies, with a different culture and a different history, so we, of necessity, sometimes have a different view of practices as they arise," Kissinger said. "But at the same time, the modern technology, and the global communications, and the global economy require that the two societies begin ever more intensive efforts to work together."

Yi Huiman, chairman of the China Securities Regulatory Commission

Yi said, China will firmly open up the capital market and hold an open, supportive attitude toward foreign companies setting up institutions and rolling out services and products. "In the meantime, we will also carefully coordinate opening-up with risk prevention." He added, "We will continue to implement a prudent monetary policy, support firms and jobs, keep major financial risks at bay and deepen financial reform and opening-up."

He Lifeng, head of the National Development and Reform Commission

He said at the event on Sunday that the economy has already shifted to a new stage of high-quality development, and the long-term positive trend of China's economy remains unchanged. In the 14th Five-Year Plan (2021-25) period, the country will make a big push to maintain the sustained and robust development of the economy, foster innovation-driven development, further upgrade industries and modernize the industrial value chain, and encourage the green transformation of production factors and activities.

Yi Gang, governor of the People's Bank of China

The PBOC, the central bank, is looking at the possibility of including climate change factors in the stress test of financial institutions, said Yi Gang. "We are also exploring the role of monetary policy in encouraging financial institutions to support carbon emission reduction," adding that the central bank will further increase the share of green bonds, limit investment in carbon-intensive assets, and incorporate climate risk factors into the risk management framework of the country's foreign exchange reserves, the world's largest. He said hundreds of trillions of yuan of investment is needed to achieve China's goal of peaking carbon emissions by 2030 and achieving carbon neutrality by 2060, or the "30/60 goal".

Carrie Lam Cheng Yuet-ngor, Hong Kong chief executive

Lam said, Hong Kong will thrive and soar higher with the full support of the central authorities. Pointing out that Hong Kong's future lies in integration with the mainland economy, while maintaining its uniqueness under "one country, two systems", Lam noted that Hong Kong will proactively become a participant in domestic circulation and a facilitator in international circulation amid the "dual circulation" development strategy of the country.

Anne Richards, CEO of Fidelity International

Richards said at the event that focusing on clean energy is conducive to China's economic growth. It will give China a leadership position in a crucial area and set up the right fuel infrastructure for sustainable growth.

Mike Henry, BHP CEO

As Chinese cities transition to high-quality urbanization, they will require more future-facing resources, including copper and nickel, for electrification and energy storage, which are central to BHP's strategy and future portfolio, he said. "We are proud that BHP and the commodities we produce have played a part in China's growth and urbanization drive over the past four decades and there is more opportunity on the horizon as China continues to grow its significance and leadership in the global economy.

Former Chinese and United States diplomats have called on Beijing and Washington to build a cooperative, positive relationship and to solve their differences in a calm and objective manner for the benefit of both countries and the world.

Speaking in a video speech delivered to the China Development Forum on Saturday, former US secretary of state Henry Kissinger said the peace and prosperity of the world depend on an understanding between China and the United States.

Kissinger spoke of the China-US high-level strategic dialogue, which concluded on Friday in Anchorage, Alaska, and said there have been some issues for discussion between the two countries.

"Fundamentally, China and the United States are two great societies, with a different culture and a different history, so we, of necessity, sometimes have a different view of practices as they arise," Kissinger said. "But at the same time, the modern technology, and the global communications, and the global economy require that the two societies begin ever more intensive efforts to work together."

The three-day China Development Forum, with the theme "China on a new journey toward modernization", opened on Saturday. More than 130 government officials, researchers and global business leaders are attending the event.

Speaking on the same occasion, former Chinese diplomat Fu Ying said China and the US should face up to and solve their differences in a calm and objective way, as cooperation is the only right choice for both nations.

The cooperation should be open, sincere and win-win in nature, instead of trying to interfere in each other's internal affairs or ganging up on China, said Fu, who is now chairwoman of the Center for International Strategy and Security at Tsinghua University.

Noting that China-US relations have experienced a sharp decline in recent years, Fu said the continued development of bilateral ties depends on whether the two countries can solve each other's reasonable concerns within the same framework of international order and realize peaceful coexistence.

It is important to start with the end in mind when dealing with bilateral relations, she said, adding that only in this way will the two countries overcome differences and focus on cooperation.

The China-US relationship today not only concerns the interests of the two countries, but also the world as a whole, she said, and that's why the international community pays so much attention to the China-US relationship and has expectations for China-US cooperation.

Preventing risks, harmonizing practices with global standards are key goals

China's top financial regulators have reiterated over the weekend the country's commitment to advance financial opening-up while strengthening risk prevention, including in regard to the China-US dispute about listed companies' compliance with US auditing rules.

Experts said the country's efforts to more closely harmonize domestic financial practices with global standards have brought great opportunities to foreign investors, though further efforts in this respect are needed.

Yi Huiman, chairman of the China Securities Regulatory Commission, the country's top securities regulator, said that China will firmly open up the capital market and hold an open, supportive attitude toward foreign companies setting up institutions and rolling out services and products.

"In the meantime, we will also carefully coordinate opening-up with risk prevention," Yi said in his address to a roundtable of the China Development Forum, held in Beijing and due to conclude on Monday.

The commission will pay particular attention to stepping up efforts to prevent a massive amount of speculative capital, also called hot money, from entering or leaving the country. It also will continue to seek cooperation with regulators in the United States for a sound resolution of the dispute surrounding US-listed Chinese companies, Yi said.

"We have been trying to engage our counterparts in the US to effectively cooperate on this issue and proposed multiple solutions, but still have not received full and positive feedback. It is our firm belief that cooperation brings win-win results and that only by sitting down and consulting each other can problems be solved and differences resolved," Yi said.

The regulatory commission published Yi's address on its website on Saturday, on the heels of the conclusion of the China-US high-level strategic dialogue on Friday and amid the ongoing bilateral audit dispute that could force US-listed Chinese companies to delist.

The nine measures to open the capital market wider that China announced at the Lujiazui Forum in Shanghai in 2019 have proved effective, Yi said. Foreign money has posted a net inflow into the Chinese A-share market for three consecutive years. Foreign holdings in A-shares exceeded 3 trillion yuan ($461 billion) by the end of last year.

China's capital market has provided foreign investors with good returns and has great potential to further attract foreign capital, Yi said, adding that the proportion of foreign holdings in total A-share market capitalization has remained relatively low at less than 5 percent.

Having learned from best practices overseas, the country's registration-based reform has achieved breakthroughs with stable operation of the pilot registration-based initial public offering system on Shanghai's STAR Market and Shenzhen's ChiNext, Yi added.

The commission will take multiple measures to pave the way for implementing the registration-based system across the whole market in a steady manner, including to urge intermediary institutions to further conform with the new system, strive for a normalized pace of IPOs, and improve the regulatory framework, he said.

Prudent policy

Yi Gang, governor of the People's Bank of China, the central bank, said at a separate roundtable at the forum on Saturday that China's monetary policy should help create an enabling environment for financial reform and opening-up.

"We will continue to implement a prudent monetary policy, support firms and jobs, keep major financial risks at bay and deepen financial reform and opening-up," he said.

Eugene Qian, chairman of UBS Securities, the UBS AG joint venture with Chinese stakeholders, said the country's continuous steps to internationalize its huge and growing capital market have provided great opportunities for UBS to develop its business in China.

"All of our business lines see promising prospects in China, so we will devote more here," he told China Daily on the sidelines of the forum.

Registration-based reform has marked a milestone for China's capital market, Qian added, as it has made stock issuance more in line with international standards, though further efforts are needed to make the issuance process more predictable.

China will take forceful and concrete measures to achieve the goal of peaking its carbon emissions by 2030 and reaching carbon neutrality by 2060 as part of the country's efforts in pursuing high-quality growth, Vice-Premier Han Zheng said on Sunday.

Han made the remark when addressing the opening ceremony of China Development Forum 2021 in Beijing.

The modernization the country is pursuing is about a balance between humans and nature, and the country is ready to pursue green, harmonized growth, he said.

Han said that China is ready to make greater contributions to the global response to climate change. The country will focus on optimizing its energy structure, controlling the amount of fossil fuel used and increasing the proportion of nonfossil sources in primary energy consumption.

It will also step up adjustments of its industrial structure, strictly control the production capacity of high-energy-consuming industries and accelerate the promotion of trading of carbon emissions rights.

Han said the new development paradigm China is building will not involve closed-door circulation, but rather a more outward-looking one with mix of domestic and international circulation. China welcomes companies from all around the world to share its market potential, and its opening-up will open wider.

Anne Richards, CEO of Fidelity International, said at the event that focusing on clean energy is conducive to China's economic growth. It will give China a leadership position in a crucial area and set up the right fuel infrastructure for sustainable growth.

He Lifeng, head of the National Development and Reform Commission, said at the event on Sunday that the economy has already shifted to a new stage of high-quality development, and the long-term positive trend of China's economy remains unchanged.

In the 14th Five-Year Plan (2021-25) period, He said the country will make a big push to maintain the sustained and robust development of the economy, foster innovation-driven development, further upgrade industries and modernize the industrial value chain and encourage the green transformation of production factors and activities.

Under the next five-year plan, He stressed that China will continue to pursue high-standard opening-up at higher levels, with a key focus on opening more sectors in a more thorough fashion and boosting international economic cooperation.

"We will boost the liberalization and facilitation of trade and investment, stabilize imports and exports, shorten the negative list for foreign investment access and improve pre-establishment national treatment," He said.

The Chinese economy is deeply integrated with the world, and its growth will be a boon for the world, offering wider cooperative space for investors both at home and abroad, he said.

"We sincerely hope and are ready to work with friends from around the world to create opportunities through opening-up, find solutions to problems and together create a better future," he added.

HONG KONG - Carrie Lam, the chief executive of the Hong Kong Special Administrative Region (HKSAR), said on Saturday that she was confident that Hong Kong will thrive and soar higher with the full support of the central authorities.

Lam made this remark at the Hong Kong Session of China Development Forum 2021, themed "The Development of Hong Kong in the Next Five Years", held online on Saturday evening.

Lam said that her confidence in Hong Kong and its future development is grounded in two major decisions made by the National People's Congress (NPC), the enactment of the Law of the People's Republic of China on Safeguarding National Security in the HKSAR in June 2020 and the decision to improve the HKSAR's electoral system to implement "patriots administering Hong Kong" adopted recently.

"These two important decisions by the highest organ of state power have put Hong Kong back on its right track, that is, fully and faithfully upholding 'one country, two systems', safeguarding national security and ensuring Hong Kong's stability and prosperity," she said.

Lam said that her confidence is further boosted by the support given by the central government to Hong Kong as embedded in the 14th Five-Year Plan for National Economic and Social Development (the 14th Five Year Plan) approved by the NPC recently.

Noting that the 14th Five-Year Plan reaffirms support for Hong Kong to enhance its status as an international financial center and strengthen its role as a global offshore Renminbi business hub, an international asset management center and a risk management center, Lam highlighted that Hong Kong's strengths in innovation and technology development was recognized in the national plan.

She elaborated on the achievements of Hong Kong as an international financial center and an innovation and technology hub and stated that many initiatives put in place by the HKSAR government, many with the support of the central government, will further boost their development down the road.

Pointing out that Hong Kong's future lies in integration with the mainland economy, while maintaining her uniqueness under "one country, two systems", Lam said that Hong Kong will proactively become a participant in domestic circulation and a facilitator in international circulation amidst the "dual circulation" development strategy of the country.

The forum was hosted by the Development Research Center of the State Council and organized by the China Development Research Foundation annually since 2000. This year's forum was held both online and onsite at the Diaoyutai State Guesthouse in Beijing from March 20 to 22. The Hong Kong Session was held for the first time and attended by over 30 invited global business leaders.

China's economic policies are expected to support the rebalance of its growth model towards greener and more consumption-oriented growth, a senior official at the International Monetary Fund said.

The policies announced during the two sessions aim to strengthen high-quality growth, rein in carbon emissions and improve energy efficiency, said IMF First Deputy Managing Director Geoffrey Okamoto. Achieving faster and higher-quality growth requires mutually enhancing reforms, he added.

Okamoto suggested reform should focus on strengthening social safety nets and green investment, opening up domestic markets, continuing reform of state companies, and ensuring that private and government-owned firms can compete on an equal basis.

"A strong effort in this direction will raise productivity and income, and lead to more balanced and consumption-driven growth," he added.

The IMF will update its global forecasts in the new World Economic Outlook coming out in early April. Despite a stronger than expected recovery in the second half of 2020, GDP remains well below pre-pandemic trends in most countries, according to the IMF official.

"China, in many ways, has already completed its recovery, returning to its pre-pandemic growth levels ahead of all large economies. But growth still lacks balance, with private consumption lagging investment. We expect consumption will catch up, as investment growth normalizes," Okamoto said, adding that China still has some room for policy actions to sustain and rebalance the recovery.

As Chinese cities transition to high-quality urbanization, they will require more future-facing resources, including copper and nickel, for electrification and energy storage, which are central to BHP's strategy and future portfolio, said Mike Henry, BHP CEO during the China Development Forum 2021 on Saturday.

Commodities, including iron ore and metallurgical coal, will also fuel the steel production needed to build new urban infrastructure, renewable energy systems and used in advanced manufacturing, he said.

By 2050, China's urbanization rate will reach 80 percent and the country will pivot into a high-income society.

"It will not be easy to advance economic growth at the same pace while protecting the environment, but China has the capability to make this a reality," said Henry.

Conducting business with China for 130 years, BHP said China has become the most important partner, the largest market, as well as an increasingly significant supplier of goods and services to the company.

"We are proud that BHP and the commodities we produce have played a part in China's growth and urbanization drive over the past four decades and there is more opportunity on the horizon as China continues to grow its significance and leadership in the global economy," said Henry.

To support China's commitment to sustainable urbanization, BHP has partnered with the Development Research Centre of the State Council to undertake research on China's urbanization to 2050.

BHP has joined hands with China BaoWu and HBIS to invest in low emission technologies to reduce emissions in steel making, which will be made available to the broader market to collectively improve the global carbon footprint.

It has also partnered with Automotive Data of China Co, a subsidiary of China Automotive Technology and Research Center, to better understand the infrastructure required as electric vehicles become more prevalent. The findings from this research will help to drive electrification in the Chinese transport sector.

As one of the major global suppliers of nickel, BHP is positioned to support the growth of electric vehicles in the world's largest auto market and continue to support China's next stage of rapid development as China's next phase of growth will come with a lower environmental footprint with the power mix to shift from one dominated by coal- to low-carbon sources, he said.

China will stay true to the commitment of expanding capital market opening-up while strengthening efforts to prevent related risks, including the China-US audit dispute, said head of the country's top securities regulator.

"We will firmly open up the capital market and hold an open, supportive attitude toward foreign companies setting up institutions and rolling out services and products," said Yi Huiman, chairman of the China Securities Regulatory Commission.

"But at the same time, we will attach importance to coordinating opening-up with risk prevention," Yi said in his address to a roundtable of the ongoing China Development Forum held in Beijing.

Particularly, the commission will step up efforts to prevent a large amount of foreign hot money flowing in and out, and continue to seek cooperation with regulators in the United States for a sound resolution of the dispute surrounding US-listed Chinese companies, Yi said.

"We have been seeking to strengthen cooperation with relevant US regulators and have proposed solutions for several times, but we have yet to receive a comprehensive and positive response," Yi said.

"Disagreements can only be resolved through negotiation," Yi said, adding that he firmly believes that cooperation will be the win-win option.

The CSRC published Yi's address on its website on Saturday, on the heels of the conclusion of the China-US high-level strategic dialogue on Friday and amid the ongoing bilateral audit dispute that could force US-listed Chinese companies to delist.

Yi added that the nine measures to open the capital market wider that China announced at the Lujiazui Forum in 2019 have already proven effective, seeing positive results.

By the end of last year, foreign money has posted a net inflow into the Chinese A-share market for three consecutive years, with foreign holdings in A-shares exceeding 3 trillion yuan ($461.1 billion), according to Yi.

China's capital market has provided foreign investors with good returns and has a great potential of further attracting foreign capital, Yi said, citing that the proportion of foreign holdings in total A-share market capitalization has remained relatively low at less than 5 percent.

Having learned from the best practice overseas, the country's registration-based reform has achieved breakthroughs with the stable operation of the registration-based initial public offering system on Shanghai's STAR Market and Shenzhen's ChiNext, Yi added.

"We will proactively create conditions for carrying out the registration-based reform across the whole marketplace," Yi said, adding that the commission will take multiple measures and improve related rules to ensure a smooth transition to the registration-based system.

For instance, the commission will urge intermediary institutions to improve their capability and further fit in the new system, Yi said, citing that some IPO sponsors are yet to be fully adaptive to the registration-based system, which has led to withdrawal of some IPO filings recently.

Yi added that the registration-based system does not mean relaxing review requirements. Shanghai and Shenzhen stock exchanges have stringently performed their duty of IPO review, while the CSRC has examined review quality of the exchanges and other major aspects such as issuers' information disclosure under the registration-based system.

The above measures have been effective and necessary, he said, citing that regulators in major markets overseas like the US also implement strict arrangements over issuance review and registration.

Peace and prosperity of the world depend on an understanding between China and the United States, said Henry Kissinger, former US secretary of state, in a video speech delivered to the China Development Forum on Saturday.

Kissinger recalled his first visit to the country 50 years ago, saying China that existed then is hard to compare with a China that exists today. "If anyone then had drawn me a picture of current Beijing, and if I compare it with what existed at that time, I would not have believed it possible that so much progress could be made," he added.

He spoke of the China-US high-level strategic dialogue that just concluded in Alaska, and said there have been some issues for discussions between the two countries.

"Fundamentally, China and the United States are two great societies, with a different culture, and a different history, so we, of necessity, sometimes have a different view of practice as they arise," Kissinger said. "But at the same time, the modern technology, and the global communications, and the global economy require that the two societies begin ever more intensive efforts to work together."

He stressed that it is important to "have cooperative and positive relations between the major industrial and technological countries in the world, and between China and the United States."

The three-day 2021 China Development Forum, which opened on Saturday, is being held online and on-site in Beijing. The theme of this year's forum is "China on a new journey toward modernization". More than 130 government officials, researchers and global business leaders are attending the event.

The global rating firm Fitch Ratings revised up the projection of China's GDP growth rate to 8.4 percent from 8 percent on Thursday, because of the strong export recovery and global demand, it said.

China's economic rebound to 6.5 percent in the fourth quarter of 2020 was described as "a remarkable achievement in the context of the pandemic" by Fitch, adding that it reflected the nation's success in containing the virus, strong investment growth and a boost to net trade as exports rebounded very rapidly from mid-year and services imports collapsed.

Fitch in its report also updated its forecast on the global GDP growth, up to 6.1 percent from 5.3 percent in its December's projection, as fiscal support is stepped up sharply, economies adapt to social distancing and vaccination rollout gathers momentum. The world GDP fell by 3.4 percent in 2020 as a whole.

"The pandemic is not over, but it is starting to look like we have entered the final phase of the economic crisis," said Brian Coulton, chief economist of Fitch Ratings.

The main driver of the global forecast revision is the much larger-than-expected fiscal stimulus package recently passed in the US. The $1.9 trillion price tag represents more than 2.5 percent of global GDP, according to the economist.

The firm expected that the rate of headline inflation in the US could rise above 3 percent year-on-year in April. The US Federal Reserve is focused on unemployment, more tolerant of higher inflation and will remain patient. Core inflation will stay well below target in the eurozone and the European Central Bank will continue to purchase assets through 2022, according to the report.

While China is the only major economy that is starting to normalize macroeconomic policy settings, where the fiscal deficit is being scaled back and credit growth is slowing as the economic recovery matures, Coulton added.

Focus on high quality to sustain global recovery, growth, say experts

China is set to enter a new stage of innovation-driven and high-quality development over the next five years, providing new impetus to global recovery and growth, experts said on Wednesday.

Xu Hongcai, deputy director of the China Association of Policy Science's economic policy committee, said China's economy is set to expand by around 8.5 percent this year after the low base of last year. During the 14th Five-Year Plan period (2021-25), the economy will grow by an average of between 5 percent and 6 percent on a yearly basis, he said.

"In the long run, we expect to see a gradual economic growth slowdown. By 2025, China's economy is expected to grow by more than 5 percent, while the per capita GDP could reach $13,000."

Xu's estimates came after China set major targets and tasks for economic and social development during the 14th Five-Year Plan period, with a key focus on fostering high-quality growth and boosting innovation-driven development.

Citing the 14th Five-Year Plan for Economic and Social Development and Long-Range Objectives through the Year 2035, Xu said China's new five-year plan will lead the country to a new journey to fully build a socialist, modern country in an all-around way, with a key focus on improving the quality and effectiveness of development.

"Guided by the new development concept, China will pursue innovative, coordinated, green, open and inclusive development," Xu said.

"Under the new plan, China will quicken the pace of building a new development pattern that will nurture a strong domestic market, with an emphasis on domestic circulation and enabling the domestic and international circulations to reinforce each other.

"In fact, China's future development will benefit both local people and foreign investors, offering new growth opportunities for global stakeholders," Xu said.

"Looking forward, China will deepen reforms and expand opening-up at higher levels, shifting the focus from simply promoting trade and investment liberalization and facilitation to expanding institutional opening up."

Zhang Yansheng, chief researcher at the China Center for International Economic Exchanges, said the country is dedicated to further opening its economy, with a key focus on building an open market, expanding institutional opening-up and boosting innovation cooperation.

Zhang said China's new development paradigm emphasizes building an open economy and bolstering ties with other nations, demonstrating the country's firm determination to deeply integrate itself into the wider global economy.

"Specifically, China will continue to cut import tariffs, facilitate trade and investment, further advance opening-up in the services sector and foster a business environment based on market principles, governed by law and on international standards such as the Regional Comprehensive Economic Partnership agreement," Zhang said.

"To foster innovation-driven development during the next five years, we need to conduct deeper global cooperation and participate in international circulation at higher levels."

Citing the new development pattern, Zhang said building an open economy will also help create a key competitive edge in international cooperation.

Wu Kai, Airwallex Greater China CEO, said the ongoing efforts to pursue high-standard opening-up and promote stable, improved performance in foreign trade and investment will create huge growth potential in the Chinese market.

"China's ongoing financial opening-up policies is good news for foreign companies, and the development of the cross-border payment sector is also of great significance for spurring vitality of foreign trade," Wu said.

"We believe globalization is an irreversible trend, With China's high-quality development and supportive policies, we look forward to playing a bigger role in China's future development."

China's economic recovery remained well on track in the first two months of the year, with surging industrial production and consumption, boding well for the world's second-largest economy's first-quarter growth results, officials and experts said on Monday.

But the jump in economic indicators, largely due to a low comparison base, cannot hide the lingering difficulties faced by small businesses and hard-hit sectors, making continuous policy support imperative, they said.

China's industrial production, retail sales and fixed-asset investment all jumped more than 30 percent in the January-February period from a year earlier, when COVID-19-induced lockdowns suspended economic activity, the National Bureau of Statistics said on Monday.

After deducting the effect of a low comparison base, major economic indicators grew steadily in the first two months of 2021, said Liu Aihua, a spokeswoman for the bureau.

Economic growth may "rally sharply" in the first quarter of the year, Liu said, citing that exports and industrial production expanded fast while consumption and investment recovered steadily in the January-February period.

China's industrial output surged 35.1 percent year-on-year in the first two months, compared with 7.3 percent in December, the NBS said.

The January-February output represented 16.9 percent growth compared with the level in the same period of 2019, as well as annual average growth of 8.1 percent in the past two years, the bureau said.

Retail sales grew by 33.8 percent in the first two months, versus 4.6 percent in December and sending the two-year average growth to 3.2 percent, the bureau said.

Li Qilin, chief economist at Shanghai-listed Hongta Securities, said the industrial production and retail sales figures have exceeded market expectations and signaled that the economy will gain more traction in the first half of the year.

Further COVID-19 containment domestically will boost consumers' demand for offline services, while the global recovery fueled by stimulus measures will strengthen demand for China's exports, Li said.

Iris Pang, chief China economist at Dutch bank ING, said the pickup in retail sales, led by jewelry, automobiles and catering, showed that consumption is on a recovery track even though social distancing measures remain in place.

Consumption will be a growth stabilizer for China this year and help offset the potential bumps in external demand, Pang said, adding that she expects China's economic growth to hit 12 percent year-on-year in the first quarter of 2021.

Though projecting double-digit economic growth in the first quarter, experts said some sectors are still suffering from the impact of COVID-19, and called for policies to remain supportive in order to revitalize businesses and address the unbalanced recovery pattern.

Liu from the bureau said the foundation of recovery is "not yet solid", as industries such as offline services have not recovered to pre-pandemic levels, adding that difficulties remain for small businesses while employment pressures linger.

The surveyed urban jobless rate came in at 5.4 percent in January and 5.5 percent in February, versus 5.2 percent in December and the government's annual control target of 5.5 percent, according to the NBS.

Also, the growth in fixed-asset investment fell short of market expectations and came in at 35 percent year-on-year in the January-February period and 1.7 percent for a two-year average, with a sluggish recovery in manufacturers' investment.

The combination of an unbalanced domestic recovery and external uncertainties surrounding COVID-19 and the global economic situation has led to calls to maintain policies to support business entities and step up efforts to expand domestic demand, Liu said.

The Government Work Report has pledged to maintain necessary support to alleviate the difficulties facing market entities, and avoided a sharp shift in macro policy.

The Outline of the 14th Five-Year Plan (2021-25) for National Economic and Social Development and the Long-Range Objectives Through the Year 2035, adopted on Thursday, also rolled out multiple measures to revitalize market entities and boost domestic consumption, such as improving property rights protection and easing market access in the services sector.

Lu Ting, Nomura's chief China economist, said he expects the Chinese government to see through the high growth figures due to a low base and stick to the "no sharp shift" commitment, with neither hikes nor cuts to policy interest rates this year.